Industry Trends

Largest Transactions Closed

- Target

- Buyer

- Value($mm)

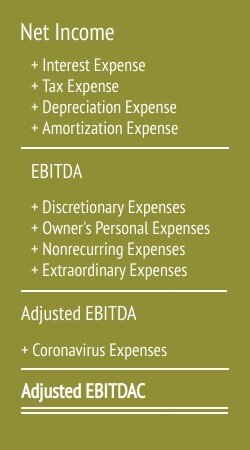

Many companies are suffering losses arising from the economic slowdown caused by the pandemic. Subsequently, these losses reduce EBITDA (earnings before interest, taxes, depreciation, and amortization), which is a significant component used in the valuation of a business.

Because of these extraordinary expenses, we expect a new acronym, "EBITDAC," to emerge. Keeping track of how the pandemic has affected your operations will help buyers understand the value of your company. In fact, taking steps now could earn you millions if you choose to sell your business later.

EBITDA is an essential measurement of a company's performance.  It isolates the operating performance by excluding the impact of financing, taxes, and accounting practices, which are mostly outside of management's control. Buyers, investors, and valuation advisors use EBITDA as a metric to evaluate the performance of a firm versus its peers'.

It isolates the operating performance by excluding the impact of financing, taxes, and accounting practices, which are mostly outside of management's control. Buyers, investors, and valuation advisors use EBITDA as a metric to evaluate the performance of a firm versus its peers'.

We have always advised our clients on the importance of adjusting historical operating results for non-business-related discretionary expenses, owner's personal expenses (owner accommodations), nonrecurring expenses, and one-time extraordinary business expenses. The resulting "Adjusted EBITDA" normalizes financial performance by excluding distortions caused by irregular expenses and those not needed to operate the business.

To preserve value for future M&A transaction or valuation analysis, we recommend that every company keep track of all its COVID-19 losses and expenses so they are easily identifiable and supportable as EBITDA addbacks. Excluding COVID-19's impact will present a clearer picture of your profitability and help increase valuation after the pandemic clears.

As you consider adjustments due to the pandemic, it is important to keep track not only of extraordinary expenses but also issues that might have created delayed or lost revenue due to the pandemic, such as:

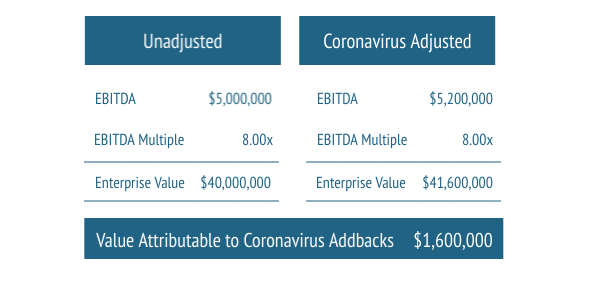

EBITDA is a critical component of the market approach to valuation. The market approach includes comparable company analysis and comparable transaction analysis. A valuation advisor will analyze publicly traded companies and recent transactions of similar companies to calculate an average Enterprise Value/EBITDA multiple (aka "EBITDA multiple"). This EBITDA multiple may be subject to adjustments for differences in company-specific factors such as size or growth. The EBITDA multiple would then be multiplied by your trailing twelve-month EBITDA to estimate your company's value.

For example, if companies operating in your industry are trading at an average EBITDA multiple of 8.0x, and you had $200,000 of coronavirus expenses or adjustments, the resulting valuation will undervalue your business by $1,600,000.  As the saying goes, "if you don't make things happen, then things will happen to you." Like other addbacks or adjustments, the challenge is to identify your COVID-19 losses now. Memories will become less clear, and the impact of COVID-19 will blend into your company's profits and losses. Keep track of your losses on a contemporaneous basis and record narrative details so that you can defend each addback, even if this is years down the line. Consider working with your accountant to create a trial balance account used exclusively for pandemic expenses. When you sell your business, the buyer will heavily scrutinize these expenses, so it is essential to keep organized and well-documented records.

As the saying goes, "if you don't make things happen, then things will happen to you." Like other addbacks or adjustments, the challenge is to identify your COVID-19 losses now. Memories will become less clear, and the impact of COVID-19 will blend into your company's profits and losses. Keep track of your losses on a contemporaneous basis and record narrative details so that you can defend each addback, even if this is years down the line. Consider working with your accountant to create a trial balance account used exclusively for pandemic expenses. When you sell your business, the buyer will heavily scrutinize these expenses, so it is essential to keep organized and well-documented records.

Understanding the impact the coronavirus has had on your financial performance, and planning accordingly, will help preserve the value of your business. Millions of dollars may be left on the table if you do not monitor and document these expenses now.

Investment Banking | ESOP

Orlando Office

407-621-2111 (direct)

djasmund@pcecompanies.com

Connect

407-621-2111 (direct)

407-621-2199 (fax)