Industry Trends

Largest Transactions Closed

- Target

- Buyer

- Value($mm)

If you’ve ever googled “how to sell my business,” no doubt you quickly realized that it seems far more complicated than you might have hoped. How will you transition out of your business? Who, if anyone, will help you sell it? These are important questions, and you should begin to consider the answers one to two years before you are ready to make your exit.

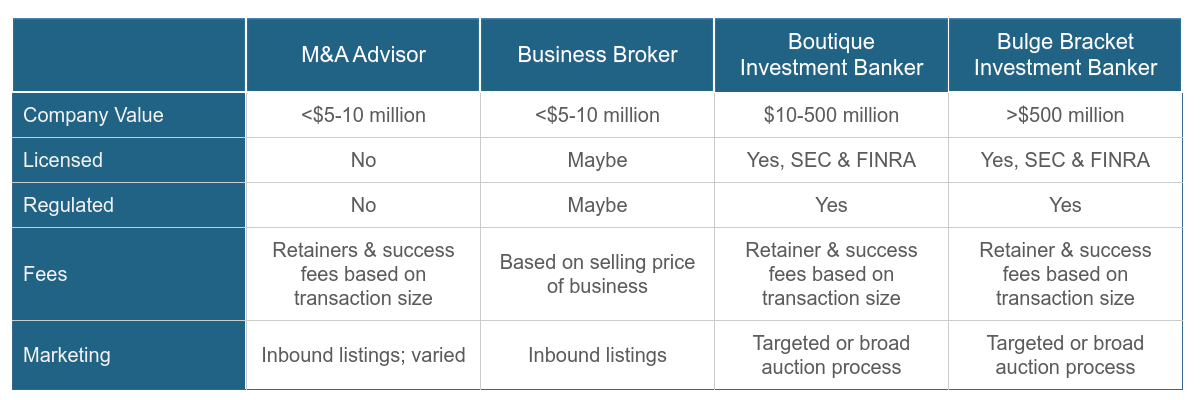

Many terms are used to describe the various professionals in the business of selling companies, with the most common being “investment banker,” “M&A advisor,” and “business broker.” Understanding the different qualifications and services provided by each type of transaction professional is an essential part of your process.

This guide will walk you through the key differentiators of each intermediary, including what to look for in a professional and what to expect during the selling process. Furthermore, you will learn why selling without a transaction professional may be tempting—but could prove to be a costly mistake.

Investment banks can be classified in two categories: Boutique investment banking firms work with businesses in the middle market range, usually valued between $10 and $500 million. Bulge bracket firms, in comparison, focus on deals with companies valued at greater than $500 million.

Both types of investment banks execute roughly the same sale process. The investment banker will first perform thorough due diligence to determine the value of your company, and then market your company through a targeted or broad auction procedure to find potential buyers. This process typically leads to multiple offers, which allows the investment banker to negotiate the best deal for you. Keep in mind that this is a high-level synopsis of what occurs during the transaction. Along the way, a good investment banker will also coach you in making your business more attractive to buyers and assist you with overcoming any unforeseen hurdles.

Only you can determine whether it’s best to hire a boutique firm or a bulge bracket firm, and you should take time to investigate firms thoroughly before hiring. Of course, the size of your company may dictate this decision. Boutique investment banks, simply due to the scope and nature of the firms they handle, will typically provide senior-level support on all transactions. If you’re hiring a bulge bracket firm, however, make sure you understand who will run your deal. Will it be a senior-level or a junior-level investment banker? When it comes to negotiating your transaction and providing suitable advice throughout the process, this individual’s standing can make all the difference.

.png?width=300&name=Selecting-Transaction-Professional-Chart-1%20(1).png)

As you explore the options available to you, researching the qualifications and past successes of various investment bankers is a must. Look at both educational history and professional experience, as prior work in the finance industry or entrepreneurial experience affords an investment banker the solid skill set and knowledge required to provide accurate guidance throughout the sale process. Also be sure to review accreditations and association memberships, which can bring added skills and a network of connections. Finally, examine any successfully completed transactions to gain insight on the number and value of those transactions. All this information should give you an indication as to whether your chosen investment banker is familiar with your industry and has the expertise to close your transaction favorably.

Equally important when considering various investment bankers for your transaction is understanding the regulatory licenses they hold. The investment banking profession is regulated by both the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA), and investment bankers are required to pass the Investment Banking Representative Exam, also known as the Series 79. According to FINRA, this exam “measures the degree to which each candidate possesses the knowledge needed to perform the critical functions of an investment banking representative,” which includes “advising on or facilitating debt or equity offerings through a private placement or public offering” as well as mergers and acquisitions, tender offers, financial restructurings, and asset sales. Determining whether a person or firm is licensed through FINRA is easy to do by searching the names through http://brokercheck.finra.org/.

Once you have vetted the investment banker’s qualifications and licenses, you need to ascertain your level of trust in this person and the firm overall. When hiring an investment banker, you are most likely putting your biggest financial asset in their hands, so speak honestly about your goals and expectations. Feeling that the investment banker has your and your company’s best interests at heart is crucial to a successful sale process.

“M&A advisor” is a self-designated title used by individuals in lieu of “investment banker,” often when they lack specific approval by the SEC and FINRA, although the individual might have obtained certifications from various associations related to M&A transactions. Some M&A advisors provide only consultative services, delivering strategy and planning advice related to exit planning or liquidity options for their clients. Others execute a complete deal process in much the same manner as an investment banker does.

When dealing with an M&A advisor, be sure you know whether this individual is properly licensed to sell a company in your state, especially if your transaction involves securities. And of course, as stated earlier, you must properly evaluate the skills and experience level of anyone you plan to hire for guidance about the future of your business.

.png?width=450&name=Selecting-Transaction-Professional-Chart-2-%20(1).png)

A business brokers is generally hired to sell smaller businesses—those valued at less than $5 million, such as restaurants, small manufacturing shops, print shops, etc.—and most likely has a real estate agent/broker’s license. These brokers can only sell the business’s assets and are not allowed to facilitate or receive a fee in a stock transaction.

Because small businesses are usually less complex, the process to sell them is relatively simple. A business broker will assist you in establishing an asking price for your business, and typically takes a passive approach to selling by listing the company online or in a newspaper. Some business brokers have ready contacts, however, and may be equipped to make an introduction quickly. As with selling any business, the time it takes to find a buyer can vary. The business broker then charges a fee based on a percentage (usually 5% to 10%) of the business’s sale price.

It bears repeating that before hiring anyone to sell your business, make sure you know their qualifications. Each state has different regulations regarding the qualifications required to sell a company. Many states require business brokers to have a real estate license, but others do not regulate business brokers or M&A advisors in any way, and do not even require a license to perform such transactions.

Before embarking on the sale of your business, make sure you understand the rules in your state. Only investment bankers, due to federal oversight of their profession, are allowed to represent companies in all 50 states.

Although some business owners may be tempted not to bother with an intermediary when selling their business, don’t be fooled by the notion that an investment banker is nothing more than a glorified networker. Studies show that business owners who partner with an investment banker have better outcomes than those who attempt to sell on their own. In fact, a 2018 study titled “Does Hiring M&A Advisors Matter for Private Sellers?” (which uses the terms “M&A advisor” and “investment banker” interchangeably) conclusively shows that hiring a professional to sell a private company leads to higher deal valuations, better negotiated terms, and added value in general.

In reviewing 4,468 acquisitions of private companies during the period 1980–2010, the authors of this report found that sale price premiums for transactions overseen by an investment banker were on average 27% to 37% greater than transactions for private sellers who did not employ a transaction professional.

The report concludes that the mere use of an investment banker can drive competition to create more negotiating influence, stating, “Previous studies find that bargaining power is a significant determinant of the magnitude of private company valuations. A key determinant of the seller’s bargaining power is the number of competing bids it receives.”

This phenomenon occurs even when no real competition exists. According to the study, “An M&A advisor can influence the attitude and assumptions of bidders. If a seller only has one strategic buyer interested in purchasing the company, using an M&A advisor can give the prospective buyer the impression that there are competing strategic buyers against which it must compete to acquire the seller.”

While the final selling price is important, it isn’t the only factor you should consider. As the 2018 study points out, business owners get better deals when using investment bankers. That’s because investment bankers:

While the urge may be strong to go it alone and forgo the fees charged by an investment banker, the added value a transaction professional brings to the deal far outweighs the expense. An investment banker adds value in numerous ways, from identifying a larger pool of potential strategic buyers, providing a valuation analysis, and proposing suggestions for increasing the value of the business to evaluating whether offers are reasonable and managing the auction process.

With so much at stake, hiring the most suitable professional to sell your business is essential. Take the time to learn about your options and what each professional can offer you. The right professional at the right time can help you take steps to shore up your company before a sale, and position you to realize the most profitable outcome.

.png?width=728&name=Download-PDF%20(1).png)

Visit our Exit Planning Library to find additional resources to help guide you through the exit planning process.