Industry Trends

Largest Transactions Closed

- Target

- Buyer

- Value($mm)

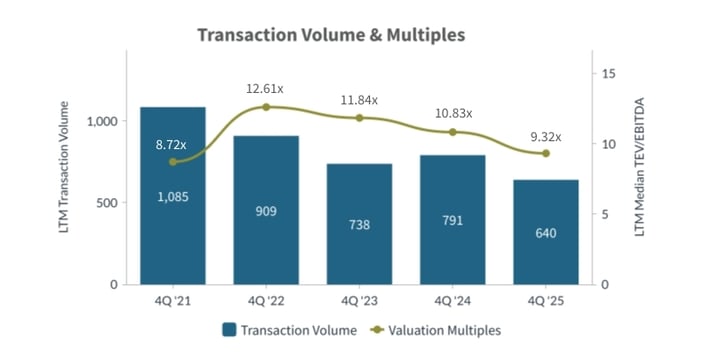

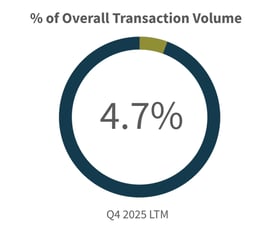

M&A activity in the Banking, Finance, and Insurance sector cooled in Q4 2025 with 640 closed transactions (LTM) compared to 791 in 2024. Despite lower volume, the market shows stability as firms focus on core competencies and digital transformation. Strategic buyers led overwhelmingly at 97.5% of deals while financial acquirers remained selective. Valuations shifted as median TEV/EBITDA moved to 9.32x from 10.83x and TEV/Revenue rose to 1.43x from 1.32x. These metrics indicate a market that values revenue stability and long-term market share during a period of consolidation. 1

“While overall deal volume in FIG has moderated, we’re seeing buyers concentrate capital into fewer, more strategic transactions that enhance scale, technology, and long-term revenue stability,” said David Jasmund, Managing Director at PCE. “That dynamic is rewarding platforms with durable cash flows and digital capabilities, even as valuation discipline tightens across the broader sector.”

In Q4 2025, Banking, Finance, and Insurance M&A faced a tightening volume environment as total deals fell to 640. Revenue multiples strengthened to 1.43x while EBITDA multiples compressed to 9.32x. Higher valuations were reserved for targets with stable top line performance and specialized financial technology. This trend highlights a shift toward acquiring market share and essential infrastructure to drive future growth despite immediate margin pressures across the broader financial landscape. 1

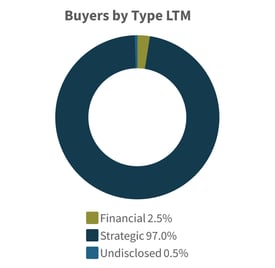

Strategic Acquirers: Strategic buyers commanded the sector by representing 97.5% of transactions. Acquisitions focused on insurance brokerage roll ups and regional bank mergers to enhance service offerings and achieve greater scale.1

Financial Buyers: Financial buyers accounted for 2.5% of deal volume by targeting high growth advisory platforms. Private equity groups prioritized assets with resilient recurring revenue and strong technological foundations.1

The US M&A market reached a pivotal recovery point in Q4 2025, marked by a surge in high-value strategic consolidations as firms capitalized on falling interest rates and a stabilizing regulatory environment. Aggregate deal value for the full year 2025 rose by approximately 45% year-over-year, fueled by a record wave of "megadeals" ($1B+) which saw values jump by over 112% compared to 2024. While overall deal volume remained relatively steady with a modest 2% increase, the concentration of capital into larger, transformative transactions signaled a decisive shift toward aggressive market scaling ahead of 2026. 4 6

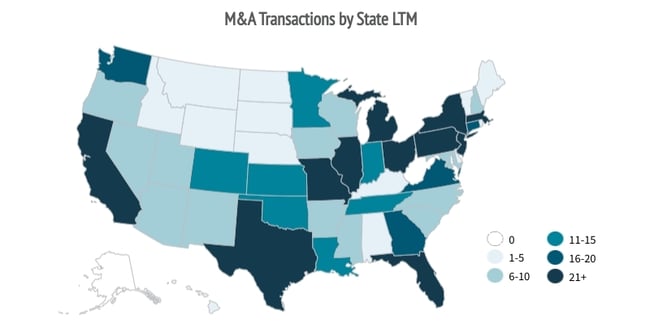

Top U.S. States: Texas led with 53 transactions followed by California with 44 and Florida with 35 to highlight key hubs for financial innovation and corporate migration.1

Cross-Border Trends: Although deal flow remained predominantly centered within the U.S. market, international buyers targeted domestic insurance and banking assets to secure stable returns and diversify their holdings against global economic shifts.1

| Target | Buyer | Value |

| Veritex Holdings, Inc. | Huntington Bancshares Incorporated | $1,882.00 |

| Bamboo Ide8 Insurance Services, LLC | CVC Capital Partners plc | $848.00 |

| Villages Bancorporation, Inc. | Seacoast Banking Corporation of Florida | $711.00 |

| American Collectors Insurance, Inc /J.C. Taylor Insurance, LLC/Condon and Skelly Inc/Heacock Classic | Philadelphia Consolidated Holding Corp. | $615.00 |

| HarborOne Bancorp, Inc. | Eastern Bankshares, Inc. | $482.00 |

| Guaranty Bancshares, Inc. | Glacier Bancorp, Inc. | $476.00 |

| Westfield Bancorp, Inc. | First Financial Bancorp. | $324.00 |

| ArmadaCare, LLC | Cirrata VI, LLC | $250.00 |

| Ryan Specialty Holdings, Inc. | Ambac Financial Group, Inc. | $226.00 |

| Tompkins Insurance Agencies, Inc. | Arthur J. Gallagher & Co. | $223.00 |

| Target | Buyer | Value |

| Onset Financial, Inc. | Silver Point Capital, L.P. | n/a |

| Advantage Surveillance, LLC | Align Capital Partners, LP | n/a |

| American Hole 'N One, Inc. | Doxa Insurance Holdings, LLC | n/a |

| Pacific Portfolio Trust Co. | Waverly Advisors, LLC | n/a |

| Pearson Ravitz, LLC | Earned Wealth Advisors, LLC | n/a |

| Target | Buyer | Value |

| Provident Bancorp, Inc. | NB Bancorp, Inc. | $222.00 |

| First IC Corporation | MetroCity Bankshares, Inc. | $205.00 |

| LifeSecure Insurance Company | Dreamscape Industries LLC | $96.00 |

| CFSB Bancorp, Inc. | Hometown Financial Group, Inc | $95.00 |

| TC Bancshares, Inc. | Colony Bankcorp, Inc. | $91.00 |

Source S&P Capital IQ as of 1/2/2026 and PCE Proprietary Data

Opportunities: Continued Fed rate cuts and a pro-business regulatory shift are expected to spark a new wave of "dream deals" and a rebound in the IPO market for tech-native financial platforms.4 5

Risks: Sticky inflation and geopolitical trade tensions, specifically around tariff implementation, remain the primary threats to deal valuations and cross-border margins.4

Predicted Activity: Large-scale "megadeals" will dominate as firms race to consolidate market share, while AI integration remains the leading driver of valuation premiums in the middle market.4 6

Served as advisor to Nuview Trust on their sale to Millenium Trust Company

Served as advisor to Florida Marketing Organization on their partnership with Baldwin Risk Partners

Served as advisor to Family Financial for equity financing.

Served as advisor to Perkins Sate Bank on their acquisition of Nature Coast Insurance.

Served as advisor to Ron Sellers & Associates as they merged with Kuykendall Insurance Group to form Sellers Kuykendall

David Jasmund |

Michael Poole |

Kyle Wishing |

|

Data Assumptions This report represents transaction activity as mergers & acquisitions, consolidations, restructurings and spin-offs. Targets are defined as U.S. Based companies with either foreign or U.S. based buyers. Transaction information provided is based on closed dates only. Glossary EBIT - Earnings Before Interest and Taxes Sources:

|

Source S&P Capital IQ as of 1/17/2025 and PCE Proprietary Data

Advised Western Milling in their sale to the Western Milling ESOP Trust

|

Data Assumptions This report represents transaction activity as mergers & acquisitions, consolidations, restructurings and spin-offs. Targets are defined as U.S. Based companies with either foreign or U.S. based buyers. Transaction information provided is based on closed dates only. Glossary EBIT - Earnings Before Interest and Taxes Sources:

|