Industry Trends

Largest Transactions Closed

- Target

- Buyer

- Value($mm)

Last updated:

A detailed weekly cash flow schedule is a useful tool that shows the financing needs of your business. This tool provides you and creditors a road map to the potential financing needs of your business. The cash flow identifies any working capital shortfalls that may require funding through a cash infusion or financing. Once built, a cash flow schedule is a continuous tool that should be updated and reviewed weekly. Having a clear picture of your cash flow demonstrates to all that you have financial control and an understanding of your business operations.

The purpose of a cash flow schedule is to forecast cash flow expectations. By nature, forecasts contain a level of uncertainty, and the longer the forecast, the more unreliable the data becomes. A 13-week period – a quarter of a fiscal year – is reasonably short enough to rely on the data. The short-term view of a cash flow schedule had reduced uncertainty but still provides a look into the health of the business.

The process for building a cash flow schedule is much like any other budgeting process. You need to identify all your revenue streams and all your expenses. The difference between a budget and a cash flow schedule is how you estimate the timing of the cash inflows and outflows. For a 13-week cash flow, you will estimate how much of your revenue will be collected (bank deposits) each week and how much you will need to pay (checks released) each week. Whereas when completing a budget, you are considering the financial performance on a yearly, quarterly, or monthly basis. You are projecting the occurrence of sales or expenses and not when the sales or expenses will be paid.

It is helpful to break expenses into fixed and variable expenses so that you can identify which week(s) in the quarter will require more cash. When creating your cash flow schedule, make sure you are capturing all expenses, even the ones that only occur yearly. It is important to know precisely when to include these in your 13-week cash flow period.

To determine your cash inflow each week, review your customers and the payment terms you have established with each of them. Next, analyze each customer’s purchasing and payment history. Knowing when a customer typically buys and pays allows you to forecast which week you are most likely to receive payment. Follow this practice for each of your accounts receivable to develop a schedule of the cash expected to be received each week. Review their paying behavior each collection cycle to make adjustments to your forecast.

For your business expenses, determine the preferred payment terms of your key vendors and forecast these expenses in the appropriate week you plan to make payment. Determine whether any of your vendors give you favorable discounts for early payment so that you can schedule those to be paid promptly while the remainder are paid on a longer time horizon. However, you might need to forgo the discounts to have a positive cash flow. Remember to pay on time those vendors that are critical to your business’s ability to stay open. Staying in good standing with your critical vendors is vital. You control the outflow of your cash. So if your cash collections begin to fall short, you can adjust as needed.

The other key component is knowing your payroll cycle, and which weeks (if not every week) these expenses are paid. Review your employee list and determine an average of these expenses over the past month to help forecast future expenses. Make sure to account for any fluctuations in the business cycle while doing this. If your cash inflow is forecast to increase due to a large project or customer order(s), make sure you estimate an increase in payroll if overtime or additional workers are required to complete the project or fulfill orders.

For your rental expense and other operating expenses, review costs for the past few months to determine which week of the month these expenses are paid and how much they vary. Many businesses handle these overhead expenses differently when creating a weekly forecast. A common way is to review the past three months of selling, general, and administrative expenses to calculate an average monthly cost. This number is then divided by the number of weeks in each month, usually four weeks.

Other outflows you may need to consider are those related to your existing debt obligations. Review your loan documents to determine when principal reductions or payments need to be made. Also, look at your line of credit documents to determine whether you are required to reduce your line of credit during the 13 weeks. Make sure you include all the related expenses, such as interest, fees, and appraisals.

Finally, are there any annual operating expenses that require a cash outflow in the next 13 weeks? These may be prepaid expenses paid out in a lump sum to obtain a discount for items, such as computer software or insurance premiums. Make sure to include these in your cash outflows for the week they are due.

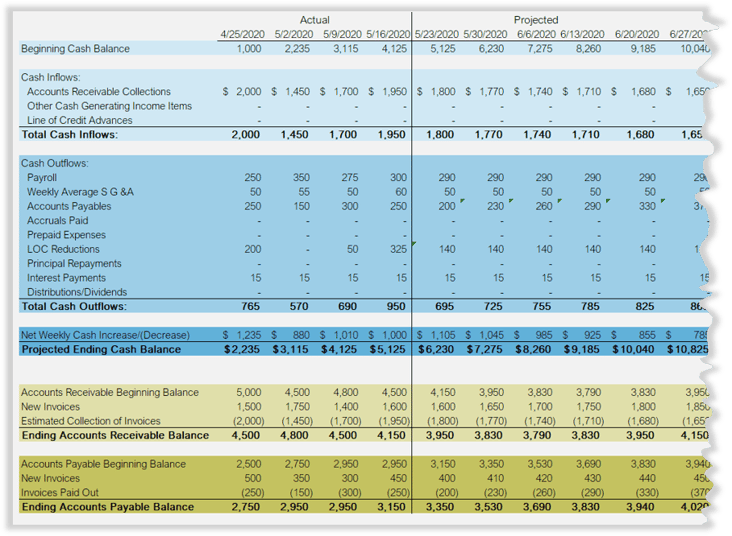

After you complete the analysis described above, create a spreadsheet to display the results of this work – see the example below. The resulting 13-week cash flow will show you which weeks have cash surpluses and which ones may require an advance against your line of credit. It will also show you how quickly you can repay this advance against your line of credit if one is needed.

Cash flow forecasting, while straightforward, does have some common pitfalls. Insufficient business records to analyze past expenses can create inaccurate data to review and lead to significant variances between projected and actual results. Communication gaps with team members who are authorized to commit funds on behalf of the company can also lead to errors in the projections. Cash may be committed for a future expenditure without being tracked on the cashflow schedule. Last, the biggest issue in forecasting is overestimating revenues, which leads to expecting too much cash collection from your customers.

A 13-week cash flow provides insight into your company’s cash standing regardless of the economic climate. In strong cash flow times, it shows you the excess cash you have, which can be used to either repay debt or fund further expansion with added capital expenditures. This tool will help you communicate to your lender the true cash generation of your business. The forecast also shows you how you can potentially grow your business. By reviewing and updating this forecast each week, you are keeping track of your expenses, which could help you reduce unnecessary spending and boost your bottom line.

Investment Banking

Orlando Office

407-621-2112 (direct)

mpoole@pcecompanies.com

Connect

407-621-2112 (direct)

407-621-2199 (fax)