Industry Trends

Largest Transactions Closed

- Target

- Buyer

- Value($mm)

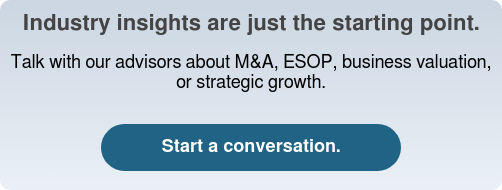

Valuation appetite remained resilient into Q4 2025. The last twelve months saw 124 transactions (28 in Q4) with median multiples of 18.16× TEV/EBITDA and 3.38× TEV/Revenue, reflecting continued competition for IP-rich, defense-electronics, mission software, and sustainment-oriented assets.

Commercial aerospace demand remained supported by resilient international travel and OEM production normalization, while defense visibility continued to benefit from sustained modernization priorities across C5ISR, munitions, ISR, and space resilience amid elevated geopolitical risk.¹ ³ ⁶

Commercial air activity was reflected primarily through aftermarket, MRO, and proprietary components transactions, as buyers targeted pricing power, PMA exposure, and long-cycle fleet sustainment rather than new-program risk, evidenced by Boeing’s acquisition of Spirit AeroSystems (aero structures and production normalization), TransDigm’s acquisition of Simmonds Precision (proprietary components and pricing power), and AAR’s acquisition of HAECO Americas (commercial and defense MRO scale).

Policy and budget dysfunction was a defining narrative for government-exposed ADG. The U.S. experienced a federal shutdown in October 2025, reinforcing contractor concerns around award timing, funding continuity, and execution pacing.¹ ² Stopgap funding dynamics (continuing resolutions) remained a practical constraint on DoD acquisition, commonly restricting new starts, production-rate increases, and certain multi-year procurement activity, compressing award windows later in the fiscal year and creating backlog-to-revenue timing risk.² ³

Despite these constraints, elevated defense priorities and demand for fighters, munitions, ISR, and readiness-related capabilities continued to support deal momentum, particularly for assets that improve industrial-base resilience and execution certainty.¹ ³ ⁶

“Budget uncertainty and continuing resolutions have introduced timing friction, but they have not diminished buyer conviction,” said David Jasmund, Managing Director. “Strategic buyers remain highly focused on aerospace and defense platforms that enhance execution certainty under constrained funding environments.”

Deals: 28 in Q4; LTM 124 (vs. 129 a year ago).

Valuations: LTM medians of 18.16× EBITDA / 3.38× revenue, expanding versus Q4 2024.

Government funding mechanics drove sentiment more than pure end-demand. Continuing resolutions and shutdown risk delayed RFPs, awards, and program starts, increasing administrative burden and uncertainty around hiring, subcontracting, and delivery schedules—particularly for services-heavy and program-start-dependent contractors.

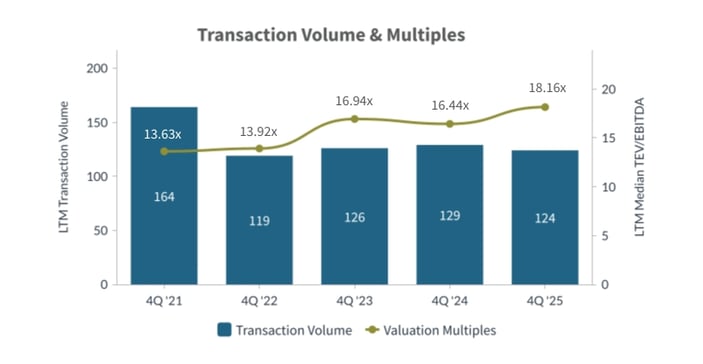

Strategics continued to prioritize vertical integration (sensors, avionics, propulsion, thermal/structural subsystems) and capabilities that improve throughput and compliance under uncertain funding; financial sponsors favored O&M-weighted and task-order-visible platforms, underwriting more conservatively for award-timing risk.¹ ² ³ ⁶

Strategic Acquirers: 104 of 124 LTM deals (83.9%), plus 4 other/undisclosed (3.2%) — activity concentrated in defense electronics, aerospace services, avionics, and mission-critical manufacturing.

Financial Buyers: 16 of 124 LTM deals (12.9%) — focus on platform carve-outs, precision manufacturing, avionics/MRO, and software-enabled defense services with durable cash flow and recompete visibility.

ADG represented approximately 0.9% of overall M&A volume in both Q4 2025 and Q4 2025 LTM, consistent with historical ranges. Despite modest volume share, valuation medians continued to outpace broader industrial cohorts, supported by multi-year defense priorities, backlog visibility, and resilient aftermarket exposure.

However, near-term execution remained dominated by appropriations mechanics, with audits noting CR-related constraints on new starts, production-rate increases, and funding ramps, which can slow modernization throughput even when strategic demand is strong.¹ ² ³

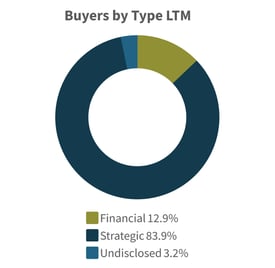

Top U.S. states by seller count (Q4 2025 LTM): California (20), Florida (15), Texas (6), Washington (5), Virginia (4), New York (4), Maryland (4).

Seller activity remained concentrated in states with dense aerospace manufacturing footprints, DoD installations, and cleared-labor ecosystems, consistent with buyer preference for established defense corridors.

| Target | Buyer | Value ($mm) |

| Spirit AeroSystems Holdings, Inc. | The Boeing Company | $8,588.00 |

| Simmonds Precision Products, Inc. | TransDigm Group Incorporated | $765.00 |

| SciTec, Inc. | Firefly Aerospace Inc. | $604.00 |

| Aero 3, Inc. | VSE Corporation | $350.00 |

| HAECO Americas, LLC | AAR Corp. | $78.00 |

| GuideTech, LLC | Palladyne AI Corp. | $46.00 |

| KinetX Aerospace, Inc. | Intuitive Machines, Inc. | $30.00 |

| Joined Alloys, LLC | Trusted Aerospace Engineering Pvt. Ltd. | $12.00 |

| Target | Buyer | Value ($mm) |

| Digital Aviation Solutions Business of The Boeing Company | Thoma Bravo, L.P. | $10,550.00 |

| Target | Buyer | Value ($mm) |

| Innovative Signal Analysis, Inc. | HawkEye 360, Inc. | n/a |

| GlobalSim, Inc. | CM Labs Simulations Inc. | n/a |

| Aerospace Control Products, Inc. | Advanced Manufacturing Company of America, Inc. | n/a |

| H.E.R.O.S., Inc. | Precision Aviation Group, Inc. | n/a |

| PCX Aerosystems Enfield, LLC | Applied Aerospace Structures, Corp. | n/a |

| QED Systems, LLC | Peerless Technologies Corporation | n/a |

| JGA Space & Defense | Torque Capital Group LLC | n/a |

Source S&P Capital IQ as of 1/2/2026 and PCE Proprietary Data

Opportunities: Defense priorities remain supportive for fighters, munitions, ISR, and readiness-related capabilities, with buyers continuing to pay for execution certainty in constrained labor and supply environments.¹ ³

Risks: Federal appropriations uncertainty (CR extensions / shutdown recurrence) may delay awards and constrain funding rates, while broader policy uncertainty can extend diligence and closing timelines.² ⁹

Expected Activity: Continued interest in assets that mitigate government execution risk, including cleared-talent platforms, compliant manufacturing capacity, and mission-critical software/electronics with sticky sustainment budgets into 2026.¹ ³

Served as advisor to Grant Aviation on their sale to Westward Partners

Served as advisor to Hop-A-Jet Worldwide Jet Charter as they became 100% ESOP owned

Served as advisor to Unique Electronics for senior debt refinancing

Served as advisor to Williams Electric Co., Inc. on their sale to Parsons

Served as advisor to Milcom Technologies for a fairness opinion

Served as advisor to Schwartz Electro-Optics, Inc. on their sale of Auto Sense to Osi Laserscan

David Jasmund |

Michael Rosendahl |

Eric Zaleski |

|

Data Assumptions This report represents transaction activity as mergers & acquisitions, consolidations, restructurings and spin-offs. Targets are defined as U.S. Based companies with either foreign or U.S. based buyers. Transaction information provided is based on closed dates only. Glossary EBIT - Earnings Before Interest and Taxes Sources:

|

Source S&P Capital IQ as of 1/17/2025 and PCE Proprietary Data

Advised Western Milling in their sale to the Western Milling ESOP Trust

|

Data Assumptions This report represents transaction activity as mergers & acquisitions, consolidations, restructurings and spin-offs. Targets are defined as U.S. Based companies with either foreign or U.S. based buyers. Transaction information provided is based on closed dates only. Glossary EBIT - Earnings Before Interest and Taxes Sources:

|