Industry Trends

Largest Transactions Closed

- Target

- Buyer

- Value($mm)

Last updated:

Ratified by ESOP-enabling federal legislation in 1974, employee stock ownership plans (ESOPs) are not new to government contractors. But many have turned their attention to the idea of selling to an ESOP as an ownership succession strategy—especially since the signing of the National Defense Authorization Act for Fiscal Year 2022 (NDAA) in late December 2021. Recently, we highlighted Section 874 of the NDAA, which contains the first government contracting program to specifically encourage ESOPs. This provision outlines follow-on contracting preferences by the Department of Defense (DOD) for government contractors owned by an ESOP. Now, owners of government contracting businesses who may have overlooked the many benefits of this alternative are asking whether they should consider electing ESOP ownership when they sell.

If you are looking to sell your government contracting business—and wondering whether an ESOP could be your most rewarding option—here are a few things to consider.

Between 2014 and 2017, nearly half of all contracting dollars obligated by the DOD went to companies with ESOP ownership, according to a study by the US Government Accountability Office (GAO). This represented about $563 billion to 622 companies. DOD officials do not consider ESOP ownership as a factor during the contracting process, instead making award decisions based on prospective contractors’ ability to deliver quality products and services both timely and cost-effectively. But the GAO study further reported that performance ratings for quality, costs, and schedules among ESOP-owned contractors were generally “satisfactory” or better.

Many articles have been written regarding the benefits of an ESOP sale for the selling shareholder owners, the company, and the employees. The tax advantages of selling to an ESOP are usually what draws business owners like you to consider this strategy. But upon closer examination , you’ll discover that the benefits also include a stronger ability to retain employees.

As any business leader knows, those two benefits can mean the difference between a thriving company and a struggling one. Profit margins in the increasingly competitive and regulated government contractor marketplace have faced downward pressure, resulting in reduced cash flow for reinvestment in the business and for return to shareholders. Given that payroll and employees comprise the largest portion of most government contractors’ expenses and that employees tend to be the largest asset for reinvestment, the temptation—or necessity—is there to tighten payroll . As a result, you may have recently found that attracting and retaining employees has become increasingly challenging.

The sale of your company to an ESOP could provide the opportunity for your company to reduce its tax burden, as the contributions made to the ESOP are tax deductible, freeing up cash you can use to reward employees. While these tax-deductible contributions are capped at 25% of payroll, most ESOP-owned government contractors enjoy a significant tax reduction or even the complete elimination of tax expense. That would potentially allow you to reinvest in your employees by providing the enhanced retirement benefits of the ESOP.

Even better, as a company providing products or services to the federal government, you may be reimbursed for your ESOP contributions. Of course, you will need to pay close attention to the costs charged to the contract, which are categorized as either allowable or unallowable. Federal rules generally state that the contributions of both cash and stock made to an ESOP plan, as long as they are not excessive and are distributed to employees’ accounts in the same year, can be charged directly to the contract. As a result, government contractors’ ESOP contributions are often reimbursed by the government.

While keeping skilled employees is a common challenge, the participatory equity ownership provided to employees by an ESOP is one of many incentives a government contractor like you can offer your employees and prospective employees. Unlike many other incentives, the ESOP benefit is typically realized at no direct cost to the employee. Studies have also suggested that employee productivity improves once a company has become ESOP owned, potentially positioning it for increased revenues and earnings. 1

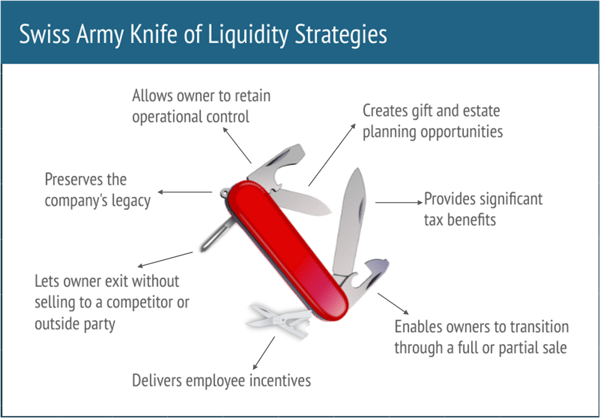

Compared with selling your business to another government contractor (strategic buyer) or to a private equity group (financial buyer), selling your government contracting business to an ESOP offers a liquidity strategy with unique flexibility. In fact, due to the numerous benefits of the ESOP strategy, we call it the “Swiss Army knife of liquidity strategies”—and several years ago, we issued an analysis by that very title.

As government contractors across the country consider selling to an ESOP, it’s worth revisiting the Swiss Army knife analogy. We called the ESOP strategy by that name because of the flexibility and customization it affords you when selling all, or even a portion, of your business. While your employees are provided with the benefit of ownership, as the owner you can make the most of the tax advantages, minimize personal and shareholder liability, enhance estate planning options, incentivize employees, and enjoy significant flexibility in the structure of the transaction.

One of the most stressful aspects of selling a business is the often public nature of the transaction, revealing information about employees, company processes, and technology. Every good business leader knows great employees make great companies—and as a successful government contractor, you know it is your employees who drive innovation and deliver superior operating results. In a third-party sale process, competitors or others who might benefit can sometimes gain insights about your key employees as well as your company’s technology and processes. The ESOP transaction allows the company and sellers to keep this information private and confidential, as this type of sale avoids the negotiating process typical with third-party buyers. Given the shrinking pool of potential employees eligible for security clearance , the confidential nature of an ESOP transaction can be a significant advantage. Even after the sale, ESOP transaction details are kept confidential.

Furthermore, since the ESOP transaction does not merge the operations into or transfer management to another business, you and your management team would continue to drive the legacy culture and operational processes. The selling shareholders may retain an active role in the business long after the sale to the ESOP, providing for continuity in relationships with your customer agencies.

Unlike asset sales, which are common in third-party transactions, a sale to an ESOP trust can only be a stock transaction. A stock sale is taxed at capital gains rates, allowing the seller to avoid the blended ordinary income tax and capital gains taxes that are levied on the proceeds of an asset sale. Even if a third-party buyer agrees to a stock purchase, the ESOP trust is also exempt from income tax liability, enabling it to avoid the potential increase in taxed proceeds from a Section 338(h)(10) election common when a third-party buys stock. Ultimately, because ESOP sales are stock transactions, you will take home significantly more proceeds.

Furthermore, if your government contractor business is a C corporation, or converts to one just prior to selling to an ESOP, I.R.C. Section 1042 allows the selling shareholders to defer all their capital gains tax liability. If managed properly, this deferral can be structured so the capital gains tax is never paid, netting 100% of the proceeds to the selling shareholders.

The sale of stock to an ESOP trust is one of the most flexible liquidity strategies and can range from a minority sale to 100% of the company stock. While the ESOP trust is zealously represented in a transaction, the burden of “fairness ” that drives the ESOP trust advisors does not translate into price, terms, and conditions that are unfair to you as the seller.

An ESOP transaction can provide many gift and estate planning opportunities to you as a government contractor, so working closely with tax advisors while designing the transaction is a must. In addition to the benefits you can leverage during the transaction, there are post-close benefits as well. Since the structure and timing of the sale of stock by the shareholders to an ESOP are flexible, many government contractors utilize the ESOP transaction to gift company shares and maximize estate planning opportunities while also minimizing gift and estate taxes. Gifting shares of stock at a lower price is another benefit, as the leveraged nature of the ESOP transaction creates a temporary drop in stock price post-transaction. This can facilitate a larger transfer of shares while staying within the federal gift tax limitations. You can also use this opportunity to sell stock to family members or key managers or to implement a stock-based incentive plan that ensures employees remain motivated to drive the stock price higher.

When deciding on the financing structure of the ESOP transaction, you also can take advantage of seller financing, which introduces numerous tools for minimizing estate taxes beyond the aforementioned gifting program. Additionally, the ESOP trust established during the transaction serves as a ready buyer for shareholders’ stock, preventing a scenario where a surviving estate beneficiary is forced to sell assets at a distressed price. Finally, the Department of Labor requires ESOP-owned companies to undergo an annual appraisal to determine the market value of the company. This annual valuation makes it less likely the Internal Revenue Service will attempt to assign its own independent appraiser to determine your company’s value, which could lead to unforeseen estate taxes.

As mentioned earlier, ESOP-owned companies often are more profitable and have more productive and happier employees. This company culture change isn’t usually the main reason business owners choose the ESOP strategy, but it still can deliver significant benefits.

Key post-transaction advantages in terms of company culture and employee morale include the following:

While Section 874 of the NDAA does implement follow-on contracting advantages that encourage ESOP ownership among government contractors, you still may face hurdles in navigating such a transition. The biggest potential obstacle would be the loss of previously held preferred status certifications. While sale to an ESOP maintains a small business set-aside designation (which could be lost in a sale to a large third-party buyer), a majority sale to an ESOP will affect certain designations (woman-owned, veteran-owned, etc.) that are helpful to some government contractors.

Although this wasn’t addressed in Section 874, lobbying efforts are ongoing to amend the laws and regulations so even 100% ESOP-owned companies can maintain their previously held certifications. Currently, an ESOP trust that owns more than 49% of the company is unable to meet the ownership standards for such designations and is considered a disqualified owner. The matter of control is also considered; certifying entities want to ensure that the eligible individual is not only the majority owner, but also in control of the company.

Certification standards differ among certifying agencies and federal government entities. Many are unclear on how the change to ESOP ownership can affect a company’s status post-transaction, and are normally unwilling to approve the future structure prior to the transaction closing. So if you are considering election as an ESOP, you risk losing a portion of your company’s revenue if the certification is ultimately denied after the transaction. This risk, even if it’s low, is enough to discourage some companies from considering employee ownership.

You only have one chance to sell your business. With so much at stake, hiring the right professional to support you during this process is essential. Many M&A professionals and investment bankers limit their practice to selling only to traditional strategic and financial buyers, and they have limited knowledge of ESOPs as an alternative succession strategy. Take time to get to know potential partners and what they can offer you.

It’s also important to seek out advisors well before it’s time to sell. Hiring the right professional at the right time can help you determine what steps to take to shore up your company in advance of a sale, so you are in the best position to realize the most profitable outcome.

Notes:

1. Steven F. Freeman, “Effects of ESOP Adoption and Employee Ownership: Thirty Years of Research and Experience.” Organizational Dynamics Working Papers, University of Pennsylvania, 2007.

2. Rhokeun Park, Douglas Kruse, and James Sesil, “Does Employee Ownership Enhance Firm Survival?” Employee Participation, Firm Performance and Survival, Advances in the Economic Analysis of Participatory and Labor- Managed Firms, 8 (2004).

3. Freeman.

4. Ibid. Also, Phillip Swagel and Robert Carroll, “Resilience and Retirement Security: Performance of S-ESOP Firms in the Recession.” Georgetown University, McDonough School of Business, March 10, 2010; Alex Brill, “An Analysis of the Benefits S ESOPs Provide the US Economy and Workforce.” Washington, DC: Matrix Global Advisors, July 26, 2012.

5. Brill.

Visit our ESOP Planning Library to find additional resources to help guide you through the ESOP planning process.