Industry Trends

Largest Transactions Closed

- Target

- Buyer

- Value($mm)

Last updated:

The COVID-19 pandemic has gifted most business owners and their employees with an unfortunate shared experience: worry over the state of their personal finances and concern about threats to the very survival of the company they either own or owe their livelihood to. Add into this turmoil over tax rates in Washington plus anxiety about personal health; it can consume one’s time and have a paralyzing impact on day-to-day activities.

With everything business owners are worried about today, why might it be the time to consider an ESOP (employee stock ownership plan)? By selling a minority position in your company to an ESOP, you can address some of these concerns and put yourself, your employees, and your company in the best position to succeed going forward. Even if the pandemic has not significantly impacted your company, you could see growth accelerated by further involving your employees in the company’s future.

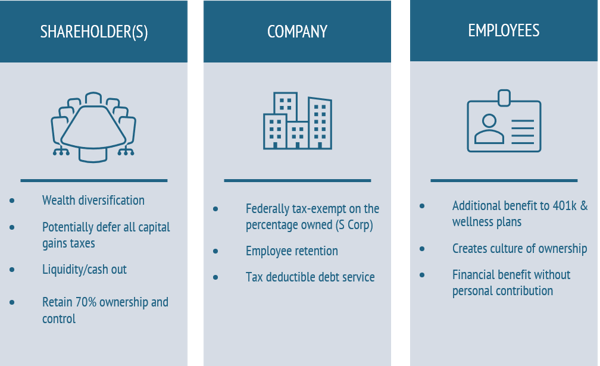

ESOPs are employee benefit plans in which employees own stock in the company that employs them. The genius in their design lies in their flexibility and the fact that they can be set up to take any size stake in the company that you and your management team think best. By selling a less-than-50% stake to the ESOP, you and your employees will benefit from:

The risk inherent in a privately held company is often forgotten when times are good. But economic downturns can quickly remind you of this risk, highlighting the importance of personal wealth diversification. Selling part of your company is one possible liquidity strategy, freeing up cash that you can deploy elsewhere. But you might be thinking that means giving up control or taking on an active (and potentially disruptive) partner in the transaction. In most cases, this is true. Most third-party buyers shy away from owning just a minority position in a privately held company, and if they do, they still want some level of control. However, diversifying your wealth through selling a portion of the business to your employees is a prudent alternative, making an ESOP a powerful tool.

ESOPs are designed to pay fair market value for the stock they purchase, but there is no mandated ownership percentage. Therefore, you can sell a smaller portion of the company to the ESOP for cash while you still maintain a majority ownership position in the company. This can generate significant liquidity for you and, at the same time, provide a meaningful, long-term wealth creation opportunity for the employees who will, studies show, reward your company with greater productivity and loyalty.

At its core, an ESOP is an employee benefit plan intended to help participants save for their retirement. In that regard, it is similar to a 401(k). The major difference is that an ESOP invests solely in your company's stock and therefore allows the participants to directly influence the value of their investment. Multiple studies show that ESOPs: i) encourage employees to be more productive, ii) engender loyalty to the company, and iii) enable them to more than double their savings for retirement, making them feel more secure. Offering an ESOP also signals to employees that they are important to your business and can enhance what is already a strong company culture or be the impetus for creating one.

We’ve previously documented ESOP tax advantages, but it is still worth highlighting that these benefits are provided whether an ESOP owns 100% or a small minority piece of the company, or anywhere in between. These benefits can include:

Finally, unlike other potential investors, an ESOP doesn’t want to run your business. An outside investor, even as a minority owner, is likely to want some degree of input into the of your operations. An ESOP only wants to be treated fairly, like the other shareholders. This gives you and your management team the freedom to continue running the business while providing employees with a significant wealth creation opportunity.

As discussed above, an ESOP is a flexible investment, conferring significant quantitative and qualitative benefits on stakeholders. We have included an example below of a 30% sale to an ESOP, highlighting some of the benefits provided to all involved.

A crisis such as this pandemic can cause you to reassess your personal situation and may drive changes that could include selling your business. A partial ESOP would allow you to take this step but do so in a manner that benefits your employees, allows you continued control of the company, and provides flexibility for the company to make strategic decisions later on when we fully emerge from this crisis.

Contact us today to get more information on how an investment banker can help you get the greatest value when selling your business. Or visit our ESOP Planning Library to find additional resources to guide you through the ESOP planning process.

Investment Banking | ESOP

Orlando Office

407-621-2124 (direct)

wstewart@pcecompanies.com

Connect

407-621-2124 (direct)

407-621-2199 (fax)