Industry Trends

Largest Transactions Closed

- Target

- Buyer

- Value($mm)

Last updated:

(and Why They Make a Great Succession Strategy)

Selling your company to an employee stock ownership plan (ESOP) offers compelling benefits for a broad range of business owners, especially those seeking tax advantages, smooth succession planning, and a motivated workforce. By providing significant flexibility in structuring the sale, ESOPs can align employee and shareholder interests, securing the long-term success of your company.

Data reveals that ESOPs are established across a variety of industries and markets. Our analysis of the ESOP universe over time provides insight into how and where most ESOPs are established and demonstrates that ESOPs continue to gain popularity and remain a viable succession strategy worth considering.

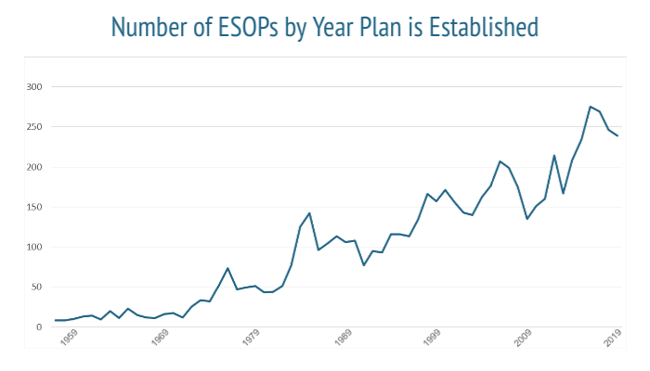

Long before Louis Kelso, in 1956, created the first ESOP for Peninsula Newspapers, Inc., the concept of employee ownership can be traced back to the earliest days of our nation1. Benjamin Franklin instituted a form of employee ownership as early as 1733 in his printing shop business, and as the nation was industrializing, companies such as Procter & Gamble, Railway Express, and Sears & Roebuck adopted forms of employee ownership programs. This momentum notably increased following the enactment of the Employee Retirement Income Security Act of 1974 (ERISA), which set guidelines for employee benefit plans and laid the foundation for the contemporary ESOP structure. In the late 1990s, Congress extended ESOP advantages by granting permission for ESOPs to own shares in S-corporations. Subsequently, S-corp ESOPs were later authorized to operate as federally tax-exempt entities, further enhancing the appeal of ESOPs.

Today, more than 6,400 ESOPs cover nearly 14 million employees nationally and hold assets of over $1.6 trillion.2 In 2020, the most recent year that data is available, 225 new ESOPs were created, and since 2015, an average of 254 ESOPs have been created annually.

While the vast majority of ESOPs are privately held, with less than 10% of ESOPs sponsored by publicly traded companies, they cover more than 12 million total participants. Outside of publicly traded companies that implement some form of employee ownership, most participants that are covered in privately held companies are in large plans (100+ participants). For instance, Publix, a majority-owned ESOP and one of the largest volume supermarket chains in the nation, has the highest number of participants, with more than 250,000 employees. Common ESOP Structures

Common ESOP StructuresWhen ESOPs are structured as S corps, they can pay little to no federal income tax. Because of the significant tax advantage, it is no surprise that more than half (64%) of ESOP-owned companies have elected S corp tax status. This structure allows ESOPs greater flexibility to accumulate cash, which they can use to pay down debt, reinvest in the company, pursue acquisitions, or plan for future payments to ESOP retirees who cash in their stock. The primary driver in selecting a C-corp structure, on the other hand, is the shareholders’ ability to defer their capital gains tax on the transaction proceeds.

When structured properly, ESOPs have been shown to provide significant benefits to employees, particularly over time. In 2021, the National Center for Employee Ownership’s Nancy Wiefek and Nate Nicholson measured the impact of ownership structure on resiliency during a crisis. Their study focused on the performance of retirement account balances in ESOP companies versus comparable 401(k) plan balances over the 2019-2020 period, based on more than 300,000 Form 5500 company filings.3 The bottom line? The average account balances in all S-corp ESOPs were roughly double the amount reflected in the 401(k) balances. The study also found that the employers contributed 94% of ESOP account funds, as opposed to just 31% in 401(k) accounts. ESOP balances represent a benefit that employees receive over and above any other corporate benefit provided at no cost to the employee. The Company funds 100% of all benefits provided to the employee through the ESOP.

In addition to higher average account balances, employees of ESOP-owned companies reported a greater sense of job security and stability. The study indicated they were laid off only one-third to one-fourth as often as employees at non-ESOP companies. A 2020 report on COVID-19-related issues by the Employee Ownership Foundation offered further evidence of this, revealing that ESOP companies were three to four times more likely to retain staff at all levels despite the pandemic—and this figure was even higher at majority ESOP-owned companies.4

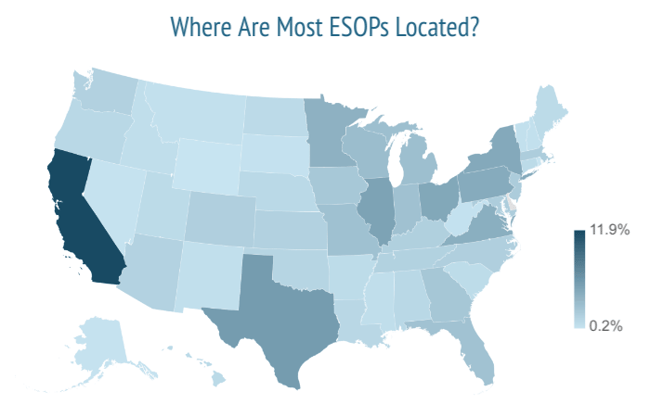

As host to 12.7% of the nation’s privately held ESOPs, California leads the nation in the number of ESOP companies at 746 and holds 8.2% of all participants at more than 158,000. On the other hand, Delaware and Wyoming have the fewest employee-owned companies, at five and 12, respectively. 2

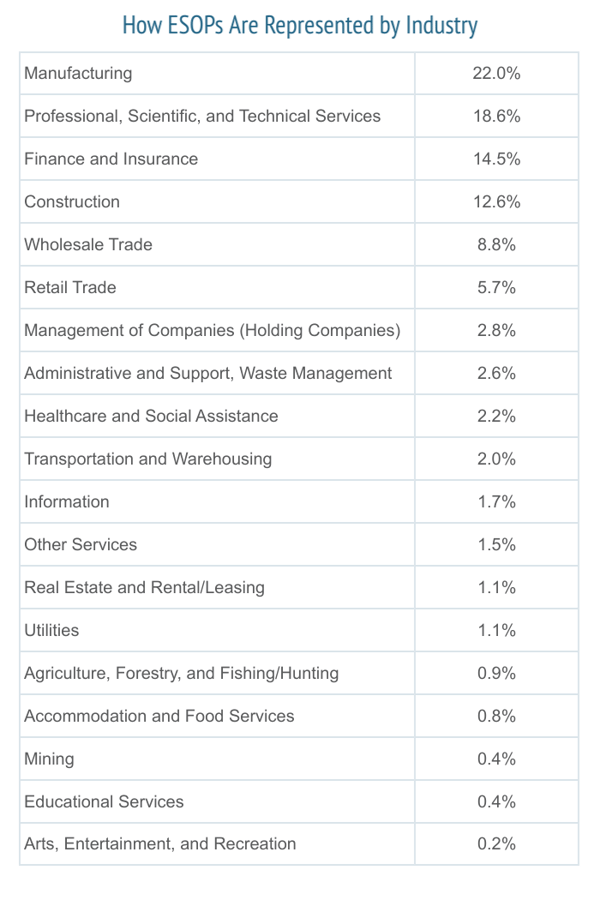

Given how flexible ESOPs are and how important it is for any company to retain and recruit a talented workforce, it is no surprise that ESOPs—which offer employees the unique benefit of ownership in a business—are represented across a wide variety of industries. Yet ESOPs are especially beneficial for companies whose most valuable asset is the employee.

According to the NCEO, more than half of the existing ESOPs operate in the professional services (21%), manufacturing (20%) and construction (15%) industries.

Regardless of the industry your company operates in, you will surely find plenty of ESOPs in both your region and your area of commercial expertise.

Having completed more than $3 billion in ESOP transactions for privately held companies of all sizes around the country, PCE is uniquely equipped to determine whether employee ownership is right for you and your business. We understand how, when, and why to sell a company — of any size — to an ESOP. If you are interested in exploring what an ESOP transaction will look like for you, your company, and your employees, contact PCE so we can help you structure the optimal exit strategy for everyone involved.

.png?width=600&name=ESOP-Stats-by-PCE-Deals%20(2).png)

1. The History of Employee Ownership, Employee Ownership Foundation

2. Employee Ownership by the Numbers, National Center of Employee Ownership, February 2023

3. Employee Ownership by the Numbers, National Center of Employee Ownership, February 2023

4. Nancy Wiefek and Nate Nicholson, “Measuring the Impact of Ownership Structure on Resiliency in Crisis,” study performed for Employee-Owned S Corporations of America, 2021

5. Employee-Owned Firms in the COVID-19 Pandemic: How Majority-Owned ESOP & Other Companies Have Responded to the COVID-19 Health and Economic Crises, October 2020

6. The Employee Ownership 100: America's Largest Majority Employee-Owned Companies, National Center of Employee Ownership, September, 2023