Industry Trends

Largest Transactions Closed

- Target

- Buyer

- Value($mm)

As a business owner, you know debt can provide an effective, low-cost solution to financing business operations. The tax deductions allowed on interest expense are an added benefit, lowering the capital cost even further. Adding debt to your capital structure also boosts your return on equity. There are different types of debt, and each has its pros and cons. Additionally, each layer of debt has different rights in the business’s capital structure and serves diverse purposes. Here, we’ll look at two common types of debt financing.

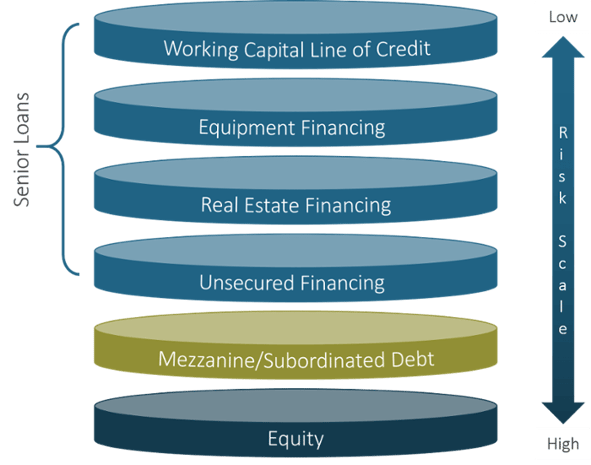

A typical capital structure for a business has two primary components: debt and equity. Each of these is broken into several tranches, which have different priorities when considering rights to assets and repayment, especially in court proceedings. These tranches also have different levels of risk and hence differing interest rates. The increasing level of risk a lender assumes with a lower claim to the business assets correlates with a higher interest rate on the capital borrowed. In other words, the lower the claim priority a lender has, the more it will cost you in interest rate expenses, and vice versa.

Most business owners are familiar with the traditional secured loan, for which the business provides collateral to the lender. This kind of loan is secured by the physical assets of the borrowing company, which can include any asset on the balance sheet — from current assets like accounts receivable to fixed assets like property, plant and equipment. The lender records a perfected lien against the company’s assets. Having collateral lowers the lender’s risk of losing the loaned amount if the borrower defaults, which enables the lender to charge a lower interest rate more attractive to the borrower. The interest rate you pay to a lender will vary and will depend on the creditworthiness of your company and current market conditions, but these days it usually ranges between 3% and 8%.

The repayment schedule for a secured loan will match the useful life of the collateral. A loan secured by assets with a shorter useful life will have a maturity date before the end of the assets’ life spans. Loans with a shorter maturity are used for working capital purposes and are normally collateralized by the business’s accounts receivable, inventory, and other current assets.

A senior secured or unsecured loan can be either a term loan, which is fully amortized over a set time frame, or a line of credit that allows you to access funds through advances and repay the bank as needed throughout the loan term. Both options typically have more favorable interest rates than does subordinated debt or equity.

Underwriting for traditional banks is based on the historical and projected cash flow of the business and current debt obligations. Senior debt lenders typically have a maximum they can lend you based on various ratios such as debt to equity, interest coverage, and fixed-charge coverage. As a rule of thumb, you can use a multiple of your EBITDA to quickly calculate your borrowing capacity. Currently, lenders are lending as much as two to three times your EBITDA. The strength of your company’s financial performance will determine whether the bank will require you to provide a personal guarantee on the loan.

As seen in the examples above, the debt component of your capital structure should match the life of the asset that you’re financing. For example, you would not borrow funds with a short maturity to buy a building or finance expensive equipment. Arranging longer-maturity loans secured by the property, plant and equipment of your business gives you the needed working capital to purchase such assets without restricting your ability to generate revenue.

Mezzanine debt gets its name from being situated below senior debt but above common shares when it comes to repayment or recovery in the event of failure. This type of debt is subordinated to senior debt, hence its other name. Mezzanine debt is one of the most expensive types of debt (though less expensive than equity financing), with interest rates typically between 13% and 17%. This debt is significantly costlier than senior debt because other lienholders have a higher repayment priority. Most mezzanine loans are unsecured, although sometimes a second lien is taken on assets permitted by senior lenders. A mezzanine lender that wishes to liquidate the collateral backing its loan typically would need to buy out the senior lienholders or initiate a court proceeding.

These loans typically mature in three to five years. The loans amortize but not fully, leaving a balloon or bullet payment at maturity. The required periodic payments are a combination of cash interest paid and principal. The total return to the lender is a combination of current interest paid, accrued interest (known as paid-in-kind, or PIK, interest), and/or convertible warrants.

Underwriting for mezzanine debt is similar to that for senior debt. The maximum amount of total debt (senior and subordinated) a mezzanine lender will advance to your company is typically three to five times your EBITDA and depends on your financial performance, along with the general outlook for your industry.

You’ll want to maximize senior debt financing before obtaining mezzanine debt due to the latter’s high cost. Inquire about mezzanine debt when you have capital needs that are above what you can get from your senior lender and you have decided not to seek an equity partner. Some reasons for seeking a mezzanine loan include having an off year, pursuing a growth opportunity, or buying out a shareholder. If you have existing senior debt when you decide mezzanine debt is needed, your senior debt holder will need to enter into an intercreditor agreement with the mezzanine debt holder acknowledging the senior debt holder’s right to perfect its lien on its collateral and agreeing to actions the mezzanine debt holder may take in the event of default.

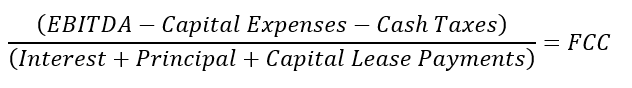

Senior or mezzanine debt financing usually requires the company to agree to certain performance covenants that entitle the lender to monitor your company’s financial status and be fully informed of potential problems. These covenants are typically tested quarterly based on your business’s performance over the previous 12 months. The most common performance covenant is the fixed-charge coverage (FCC) ratio, which shows how well your business’s cash flow can cover the company’s fixed expenses. The FCC is determined by the following formula:

The industry-standard minimum FCC ratio is 1.25x; the higher your ratio, the better positioned you are to repay your debt. An FCC ratio of 2.5x means you can pay for your business’s fixed charges two and a half times.

Additional performance covenants include:

The optimal capital structure is different for each company, and an analysis of specific needs will drive what type of debt is needed. How you will use the funds and how long you need the funds factor into the type of financing needed. The lender’s level of involvement is also a key component to consider— specifically, the type of financial performance covenants that will be required based on the type of lending you are seeking.

Finding a suitable lender can be a difficult task. It’s a good idea to hire an investment banker who can help you navigate all the available options and find the best financing solution for your needs. With nearly 25 years in the industry, PCE has a wealth of experience raising capital, both senior and mezzanine, for clients like you.

Investment Banking

New York Office

201-444-6280 Ext 4 (direct)

cquintos@pcecompanies.com

Connect

201-444-6280 Ext 4 (direct)

407-621-2199 (fax)