Industry Trends

Largest Transactions Closed

- Target

- Buyer

- Value($mm)

Last updated:

In today’s economy, intangible assets are often the most valuable part of a company, especially in service-based and technology-driven businesses. These non-physical assets, like intellectual property and brand reputation, can account for more than half of a company’s total enterprise value.

Yet many business owners ask:

“How do I value my intangible assets?”

Let’s start with what we mean by intangible assets.

These assets are not found on the factory floor - but they’re central to business value.

The Multi-Period Excess Earnings Method (MPEEM) is a commonly used income-based valuation method for intangible assets.

The Multi-Period Excess Earnings Method (MPEEM) is a commonly used income-based valuation method for intangible assets.Understanding the MPEEM and other methods for valuing intangible assets is important for a few reasons. Here’s when this approach becomes essential:

Strategic Planning: Understanding the value of your company’s intangible assets can help you make strategic decisions, such as deciding whether to enter a particular market or how to price products.

Fundraising: When raising capital, you might need not only to prove your business’s value to investors, but also to show your intangible assets’ value to persuade them to invest. Whether those intangible assets are internally created or gained through acquisitions, understanding how to value them and prove to investors that they can create profits is crucial when trying to raise the capital you need.

Mergers and Acquisitions (M&A): Understanding how to value intangible assets can help you negotiate a fair price in an M&A transaction. Following your acquisition of another company, that understanding can help you assess and capitalize the assets obtained.

Accounting and Reporting: Because you must report the fair value of intangible assets on financial statements, understanding the MPEEM, as well as other valuation methods, can help you determine the proper values to report.

Competitive Analysis: Understanding the value of competitors’ intangible assets can help you understand their market position and identify opportunities for differentiation.

The upshot is that understanding the MPEEM and how this method compares with other methods for valuing intangible assets can help you make informed decisions about your business’s management and growth.

The first step in using the MPEEM to value your company’s primary intangible asset is identifying the asset and its potential uses. As part of this step, you will want to consider expectations and estimate future cash flows the asset will likely generate. This process typically involves assuming the market size for the asset, the asset’s penetration rate in that market, and the expected margin on sales of the asset.

asset and its potential uses. As part of this step, you will want to consider expectations and estimate future cash flows the asset will likely generate. This process typically involves assuming the market size for the asset, the asset’s penetration rate in that market, and the expected margin on sales of the asset.

Once you estimate the future cash flows, you can use a discounted cash flow (DCF) model to estimate those cash flows’ present values. The discount rate used in the DCF model should reflect the risk of that asset’s cash flows and be consistent with the risk of other investments with similar features.

When using the MPEEM to value your company’s primary intangible asset, remember some important things. One is that the method relies heavily on assumptions about future cash flows and market conditions, which can be difficult to predict. Another is that the method might not account for all the asset’s possible uses, so the value estimate might be low.

Finally, like other valuation methods, the MPEEM will be more accurate when combined with other methods and after critical analysis. Intangible asset valuation is not an exact science, and you must be transparent about the assumptions and methodologies used when presenting the value estimate.

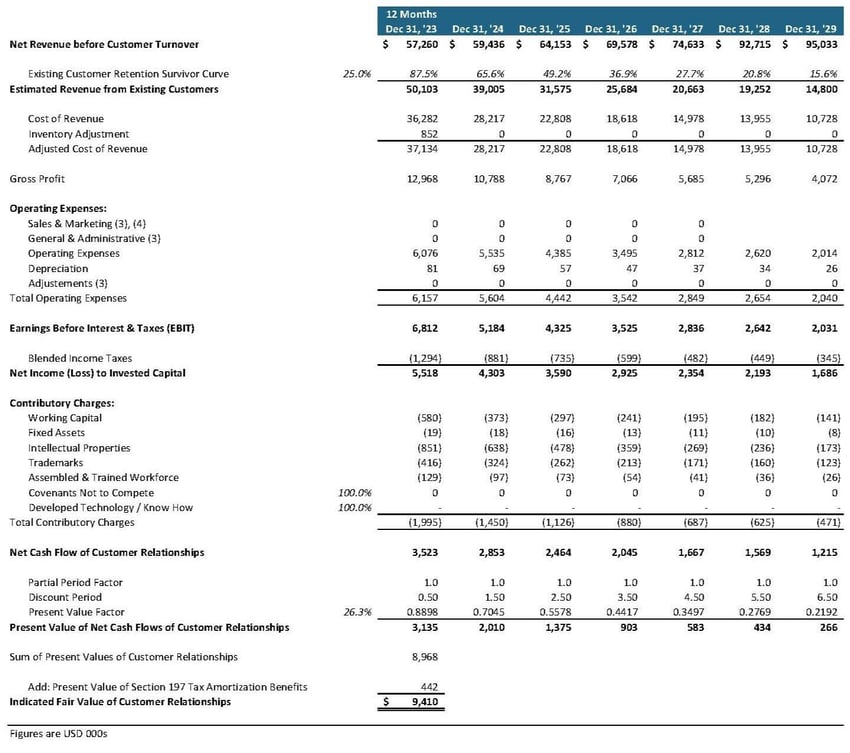

A valuation professional held detailed discussions with the management of Company X, the target of an acquisition, to identify Company X’s tangible and intangible assets. Based on these discussions, these assets were identified: net working capital, fixed assets, customer relationships, intellectual properties, trademarks, and assembled workforce. These discussions determined that customer relationships were Company X’s primary asset.

The following reflects the valuation analysis of Company X’s customer relationships:

Observations:

Observations:As this article demonstrates, using the MPEEM to value an intangible asset can be complex. Further, a purchase price allocation that uses the MPEEM to determine a particular intangible asset’s value adds complexities. As illustrated above, there are several factors and assumptions must be considered when using the MPEEM.

When selecting which methodologies to use to value individual intangible assets, consider the facts and circumstances unique to your company and its assets. Much research, thought, and experience are required when using the MPEEM, especially when performing a purchase price allocation. If you are considering how to value your intangible assets or need to perform a purchase price allocation, we highly recommend hiring a qualified valuation analyst — the benefits of doing so far outweigh the costs.