Industry Trends

Largest Transactions Closed

- Target

- Buyer

- Value($mm)

Last updated:

Business owners thinking about selling their company almost always have the same two questions:

That is why PCE provides a free business valuation before engaging with clients. The valuation enables you to be better informed when making critical decisions and helps you determine if now is the right time to sell. A preliminary business valuation ensures alignment on value expectations before you consider your exit strategy. The valuation also showcases how we operate at PCE. This is the first opportunity to demonstrate the value of our experience and knowledge and is the best way for you to decide if we’re right for your company. You can expect a reasoned fee proposal based on a realistic estimate of valuation. Learn more about M&A fees and what to expect.

Here’s what happens during the preliminary valuation process:

The purpose of the meeting is for all parties to get acquainted. This is a casual conversation to get to know one another and for us to understand your goals and objectives. Our investment bankers will tell you about their experience and qualifications, and you should be ready to do the same. Be prepared to speak briefly about topics such as:

It is essential that we understand how your company operates so we can determine the value. Providing this background information is crucial to providing you correct information.

It is essential that we understand how your company operates so we can determine the value. Providing this background information is crucial to providing you correct information.

Concurrent with the introduction call, we will send you a Non-Disclosure Agreement, which may be executed before the introduction call if necessary. We will also send a list of due diligence items needed to perform our preliminary valuation.

We hope to become your most trusted adviser, but we just met, and confidentiality is at stake for both parties. To assure that confidentiality is maintained, we ask that you sign a Mutual Non-Disclosure Agreement, an essential step when selecting your transaction partner. This legal document protects you and your information. You can be assured that…

✔ Your information will be kept private.

✔ Information shared will be used solely for exploring the possibility of an engagement.

✔ Your contemplation of a transaction will remain confidential.

Along with the NDA, we also provide an initial due diligence request list. We understand the possible burden to track down a list of documents, so we only request the most critical information needed for a preliminary valuation. These pre-sale due diligence tips can help streamline the process.

Our request list typically includes the following:

We begin analyzing the data as soon as we receive the requested documents. We examine how your business has been performing in recent years and how it supports your financial forecast assumptions. We are looking for support that the financial forecast is reasonably achievable. Additionally, we assess the current conditions of your industry, market, and competitors. We must understand the playing field since these external forces impact your future performance. Addressing these factors can also help you avoid scenarios where your business won’t sell.

Our analysis typically results in follow-up inquiries as we dig into the data. We will usually ask for another meeting to perform our PCE Operations Assessment and discuss specific items discovered in our analysis. It’s crucial to address these questions so we’re prepared when a potential acquirer inquires similarly in their valuation analysis (and they always will). We will uncover operational strengths and weaknesses that go into calculating value. Along with our preliminary valuation, we will also provide a written report of our Operating Assessment findings.

Now that we have a strong understanding of your business operations and have analyzed the financials, we will prepare our preliminary valuation of your company. This preliminary valuation will provide an estimate of what your company could sell for in the market. It is heavily reliant on the validity of your information. It does not account for synergistic premiums a particularly strategic buyer might offer.

There are several widely accepted valuation methodologies, and no one method can precisely pinpoint your company’s value. We take multiple valuation approaches and triangulate the results to provide an estimated range of value. The Income Approach attempts to simulate the economics of a particular company, while Market Approaches stress the comparative characteristics of reasonably competitive companies.

A standard income approach methodology for valuation is the Discounted Cash Flow Method. This valuation method examines the future income stream that could be paid to the business owner. this method equates the business value to the amount an investor would be willing to pay for the right to receive those future cash flows. An estimate of the appropriate rate of return that would attract an investor is used to discount future cash flows to present value.

This valuation approach is highly dependent on a justifiable financial forecast and an applicable discount rate. We will examine past financial performance and consider future business opportunities as we assess the validity of financial projections. We will develop a risk profile of your company to estimate a discount rate. Risk factors that impact the discount rate include current interest rates, equity risk premiums, company size premiums, and company/industry-specific risk premiums.

The Comparable Company Method relies on trading multiples and ratios from the sale of publicly traded stocks of companies in the same line of business. We determine the comparability of public companies in your industry by analyzing size, growth, profitability, leverage, turnover, and liquidity.

Once a group of companies is deemed comparable, we analyze how they and your company differ in size. This differential indicates if a size discount is needed to adjust the comparable companies’ average multiple. This size discount adjustment is applied to identify the added risk a smaller company may face.

We typically evaluate enterprise value (“EV”) multiples on a last-twelve-month and projected-next-twelve-month basis. These multiples include EV/EBITDA, EV/EBIT, and EV/Revenue. We apply the selected trading multiple adjusted for size to your company’s financial metrics. This method estimates the value of your company based on how it might trade in the public markets.

Another market approach to valuation is the Precedent Transaction Method. This method relies on multiples from the acquisition of companies in the same line of business. The assumption is that the historic price paid for a similar company is a reliable indicator of your company’s value. We review recent merger and acquisition transactions in your industry to see what was paid for comparable companies.

Like the Comparable Company Method, adjustments for size differentials are applied to transaction multiples, if necessary. We evaluate multiples on a last-twelve-month basis as of the individual transaction dates. These multiples include Entity Value (EV)/Revenue, EV/ EBITDA, and EV/EBIT.

The selected transaction multiple adjusted for size is applied to your company’s financial metrics. This methodology estimates the value of your company based on what other recent transactions are indicating is a market price.

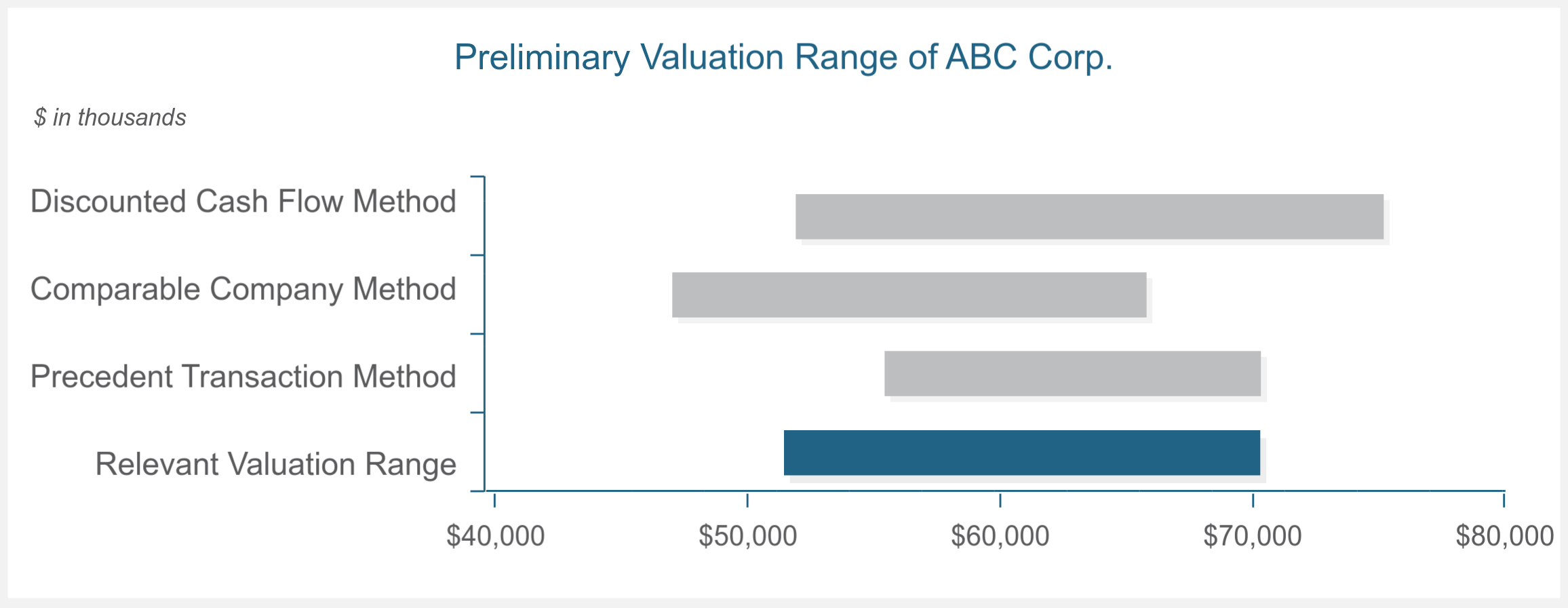

We triangulate the value ranges calculated from the three methodologies to conclude a valuation range for your company in alignment with how a buyer values your business. This ensures that our relevant valuation range is considering company-specific and market factors. Below is an example of how our preliminary valuation findings play out to a well-conceived value range.

This shows the results of each methodology and how the relevant valuation range compares. This represents the Enterprise Value of a business. The total consideration received in the sale is adjusted for cash, debt, and working capital requirements.

We will fully explain our preliminary valuation results, answer any questions you have, and share our thoughts on a solid market strategy. As your long-term trusted adviser, if we think now is not the right time to sell, we’ll tell you so plainly. We will provide seasoned guidance on timing and describe the types of buyers that our experience tell us may be interested. The goal of our preliminary valuation is to provide you with the information you need in order to make the best decisions for yourself and your company.

Discover the value of your business and decide if now is the right time to sell? Fill out the form below to request your free preliminary valuation or contact one of our experienced investment bankers.

Take the first step toward making informed decisions about your business’s future. Don’t wait—start planning your successful exit strategy today!