Industry Trends

Largest Transactions Closed

- Target

- Buyer

- Value($mm)

Last updated:

Employee engagement is a hot topic in the business world, touted for its ability to boost morale, reduce turnover, and improve customer satisfaction. But for business owners, particularly those considering an exit strategy or future capital raises, the true value of employee engagement lies in its impact on company valuation. The valuation impact of these types of changes goes beyond anecdotal evidence and can be quantified using a variety of metrics and appraisal techniques. For business owners exploring succession strategies, understanding what an ESOP is can provide insight into an employee-ownership transition model.

Company valuation is the process of determining the value of a business. Conducting an ESOP feasibility study can help determine whether an employee ownership structure is a viable strategy for maximizing valuation. This value is crucial for various scenarios, including mergers and acquisitions, ESOP implementations, and attracting investors. Several valuation methodologies are used, each with its strengths and weaknesses. Common methods include:

Now, let's delve into how employee engagement directly influences the factors considered in these valuation methodologies:

Increased Revenue and Profitability: Engaged employees are more productive and innovative. They go the extra mile, contributing to higher-quality work and improved efficiency. This translates to increased sales, reduced costs, and ultimately, higher profitability. Higher profitability directly translates to a higher valuation under all methodologies.

Reduced Costs: Engaged employees are less likely to commit errors, take unnecessary absences, or cause safety incidents. This reduces operational costs, further boosting profitability.

Improved Customer Satisfaction and Loyalty: Highly engaged employees are more customer-centric. They deliver excellent service, leading to higher customer satisfaction, greater loyalty, and repeat business. This translates to more predictable revenue streams, a key factor in the DCF method, and means your company can command a premium valuation multiple in comparison to the public competitors or the multiples paid for similar firms that were acquired.

Specifically, and according to the market research and polling firm Gallup,[1] actively disengaged employees cost their organization 34 percent of salary through lost productivity. For example, a hypothetical firm spending $10 million on payroll could increase profit by $3.4 million if the staff went from fully disengaged to fully engaged—a significant boost to the bottom line.

Reduced Talent Acquisition and Retention Costs: Companies with high employee engagement experience significantly lower turnover rates. This translates to lower recruitment and training costs, which directly improve the company's cash flow, a positive factor in the DCF method. Additionally, lower turnover reduces the risk of losing key talent and knowledge—a significant concern for investors—which can lead to a higher valuation multiple.

Improved Operational Efficiency: Engaged employees are more likely to follow established processes and identify areas for improvement. This reduces operational risks, such as production delays or quality control issues, which are factors considered in DCF valuation when projecting future cash flows.

Stronger Brand Reputation: Engaged employees become brand ambassadors, promoting the company positively in their communities. A positive brand reputation attracts new customers (revenue) and talent (reduced recruitment costs), ultimately impacting value in a positive way.

Innovation and Intellectual Property: Engaged employees are more likely to contribute innovative ideas, leading to the development of new products and services. This translates to a stronger competitive advantage, increased revenue potential, and potentially patentable intellectual property—all factors that can increase valuation.

While the positive impact of employee engagement is clear, quantifying its effect on valuation requires a data-driven approach. Here are some key metrics to track:

By tracking these metrics over time, you can establish a link between employee engagement and improvements in financial performance, brand reputation, and overall business risk profile. This data can be used to support a higher valuation during negotiations.

Cultivating a culture of employee engagement is an ongoing process. Here are some practical strategies to implement:

Employee engagement is not just about keeping employees happy. It's a strategic investment that directly impacts a company's financial performance, risk profile, and, ultimately, valuation. By fostering a culture of engagement, you empower your workforce, unlock hidden value within your company, and position yourself for a successful exit strategy or future capital raises. For owners seeking partial liquidity while maintaining control, an ESOP can be a strategic alternative.

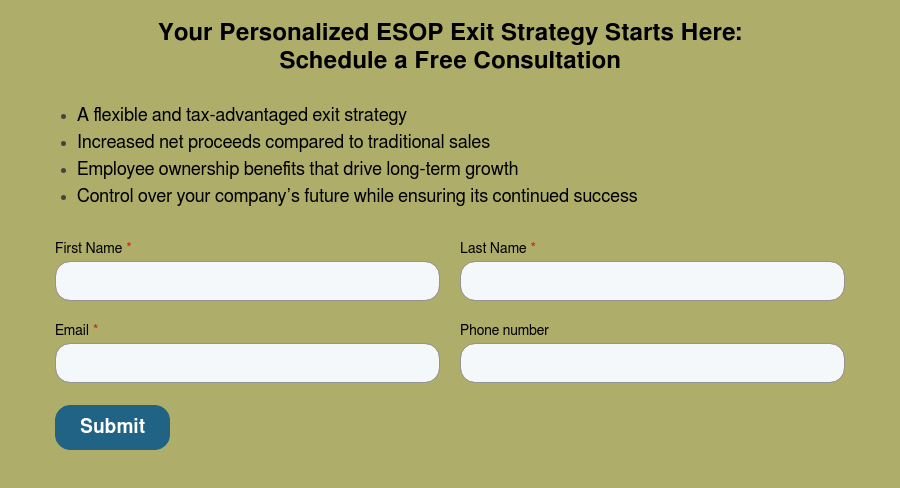

Selling your business is a major decision—why not choose a strategy that maximizes your proceeds, minimizes taxes, and secures your legacy?

Fill out the form below to contact our expert ESOP advisors today. Let’s discuss if an ESOP is right for you.

[1] Gallup, “State of the Global Workplace,” October 8, 2013.