Industry Trends

Largest Transactions Closed

- Target

- Buyer

- Value($mm)

Last updated:

When deciding to pursue an exit strategy, many business owners focus on the transaction purchase price—what the buyer paid for the business. Before the seller receives proceeds, however, this amount is subject to adjustments, escrows, and other transaction expenses. The more important and useful figure to focus on is net proceeds received. As a business owner who understands this before beginning the sale process, you will be far more likely to set appropriate expectations about how much cash you will receive at closing.

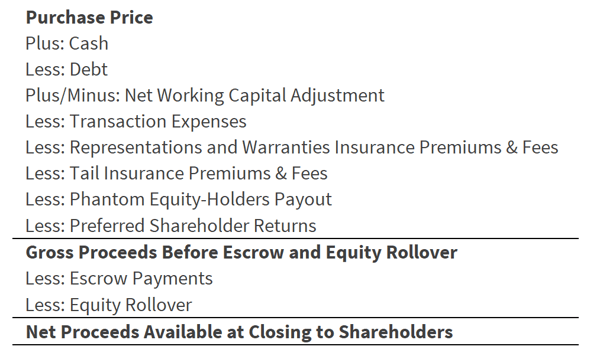

In a mergers and acquisitions (M&A) transaction, a "flow of funds" or "proceeds waterfall" is created to show the inflows and outflows of cash at closing. While every transaction is different, the adjustments and expenses presented in the simple example below—and in the descriptions that follow—are typical of most M&A transactions:

Purchase Price

Purchase PriceTypically, the purchase price represents a cash-free, debt-free transaction, which means you (as the seller) get to keep your cash but must pay off your outstanding debt at closing. Cash includes savings and checking accounts, as well as cash equivalents such as money market accounts and investment accounts. Debt includes notes payable and any line of credit balances that are outstanding, and often also includes debt-like liabilities such as outstanding tax liabilities and lease obligations. Which liabilities are considered debt is a point to be agreed upon during negotiations, so there is no question of what will be paid off at closing.

The net working capital (NWC) adjustment is applied to the purchase price to make up the difference between the working capital available at closing and the working capital needed to run day-to-day operations. Calculated as the company's current assets excluding cash subtracted by current liabilities excluding debt, NWC can fluctuate daily. This adjustment assures the buyer that despite the NWC calculated at closing, the company has sufficient working capital to operate going forward. Once the buyer and seller agree on a targeted NWC (based on the historical average NWC), if the company holds a working capital balance below the target, the transaction purchase price is decreased to fund the working capital difference. Performed on the closing date, this estimate is often reassessed 60-90 days later when balance sheets are finalized, leading to another true-up adjustment based on the actual NWC and an escrow associated with this adjustment.

Transaction expenses are your responsibility as the seller and must be paid at closing. Defined in the purchase agreement, these expenses often include the following categories:

Although a portion of the sale proceeds traditionally has been put in escrow to mitigate risks after closing, R&W insurance has become more popular in recent years as an alternative to escrows in M&A transactions. This type of insurance protects against loss due to a breach in the seller’s representations in the purchase agreement. As with standard insurance, buyers will pay a premium up front, typically based on a percentage of the transaction purchase price. Other costs associated with R&W insurance may include underwriting fees or broker fees.

In deciding between R&W insurance and an escrow account, business owners must consider the particular transaction and the risks involved. As the seller, you must pay the insurance premiums regardless of whether a claim is made, but you are protected from further losses covered by the R&W insurance, depending on the policy. With an escrow, you must pay only if a claim is made, but the potential loss could be greater because you have no insurance protection.

For further protection from losses that might occur after closing, sellers may consider adding tail insurance coverage, which enables the insured party to make a claim against an existing policy that has technically expired. In essence, this additional insurance policy extends the seller’s current policies beyond closing. This type of coverage is often used to hedge losses that may arise from a claim made after closing about an event that occurred before closing.

Phantom stock is a financial instrument that mimics regular stock in a company but does not grant equity ownership. Examples include deferred compensation plans, stock appreciation rights, and stock options—financial instruments given to select employees as compensation. Phantom stocks typically include a change-of-control provision, which would entitle the phantom equity-holders to be paid off with proceeds from the sale. Not all companies have phantom stock, so this may not apply to all transactions.

Preferred stocks are securities that give the holder priority on a company's assets and earnings but usually do not confer voting rights. In this arrangement, the preferred shareholder return must be paid to those stockholders before distributing proceeds to common stockholders. As with phantom stock, preferred shares may not be applicable in some transactions.

To protect the seller from issues that may arise post-closing, funds may be set aside as escrow. In some instances, an indemnity escrow is created, in which a portion of the purchase price is held to cover indemnification claims against the seller and to compensate the buyer for damages. The duration of an indemnity escrow fund is contingent on the R&W survival period, which can range from one to two years. Another option is a net working capital escrow, which secures a portion of the proceeds to true up the difference in the actual and working capital adjustments, typically calculated 60-90 days after closing. Whether choosing one of these or another type of escrow account to ensure security in various circumstances, both the buyer and the seller must agree on the amount and duration.

Common in private equity deals, an equity rollover is when you retain a portion of ownership of your business post-transaction. A buyer may prefer this arrangement, which often reduces their risk exposure because the seller still has "skin in the game." Equity rollovers are viewed positively by buyers, as this willingness to keep some ownership communicates that the seller is bullish on the company's future performance. From the seller's perspective, you have an opportunity to partake in future growth and get a "second bite at the apple" when the new owners sell the business in the future. The equity rollover will reduce the cash proceeds at closing, however, so it is essential for selling shareholders to understand the implications.

After all the purchase price adjustments are made, the transaction expenses are paid, the escrows are funded, and the phantom and preferred shareholders are compensated, the remaining net proceeds are distributed to the common stockholders according to their respective ownership percentage. Each shareholder has a different tax responsibility based on the capital gains earned from the company's sale. Consulting a tax accountant is essential to ensure each individual's tax situation is addressed accordingly.(1)

Above all, remember that each transaction is different, and the payments discussed above are not exclusive or inclusive of all that may apply to a particular transaction. At PCE, our investment banking advisors have substantial experience navigating flow of fund structures and providing guidance on how net proceeds may differ from the purchase price in a contemplated transaction. Contact us today for more information.

(1) Disclaimer – PCE Companies and its affiliates are not tax professionals and are not providing tax advice. Each individual's tax situation is unique, and we recommend consulting with a tax professional.

Investment Banking

New York Office

201-444-6280 Ext 3 (direct)

mmoran@pcecompanies.com

Connect

201-444-6280 Ext 3 (direct)

407-621-2199 (fax)