Industry Trends

Largest Transactions Closed

- Target

- Buyer

- Value($mm)

Last updated:

Strategic buyers are often willing to pay more than what financial buyers will pay due to the synergies generated in the transaction. Synergies are often a contributing factor driving strategic buyers to make acquisitions. As a business owner, it is important to understand how strategic buyers analyze synergies and how that impacts what they are willing to pay.

Strategic buyers have different motivations to make acquisitions compared with financial buyers:

Synergies are often described as situations where “the whole is greater than the sum of its parts.” In corporate M&A, a synergy is generated when a merged company is more valuable than the two separate companies. Different types of synergies motivate strategic acquisitions. Common synergies include:

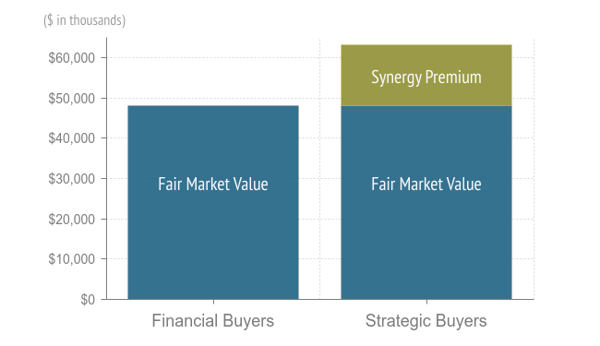

The amount that a strategic buyer is willing to pay for the synergies is known as the synergy premium. Synergy premium is calculated by taking the present value of future synergy benefits generated in the merged entity.

Strategic buyers need to develop pro forma financial forecasts when considering a synergistic acquisition opportunity by adjusting the target company’s financial forecast for perceived synergies. Due diligence efforts will focus heavily on validating the synergies and scrutinizing their sustainability.

Strategic buyers need to develop pro forma financial forecasts when considering a synergistic acquisition opportunity by adjusting the target company’s financial forecast for perceived synergies. Due diligence efforts will focus heavily on validating the synergies and scrutinizing their sustainability.

Let’s look at an example to better understand how synergies impact what a strategic buyer is willing to pay for an acquisition.

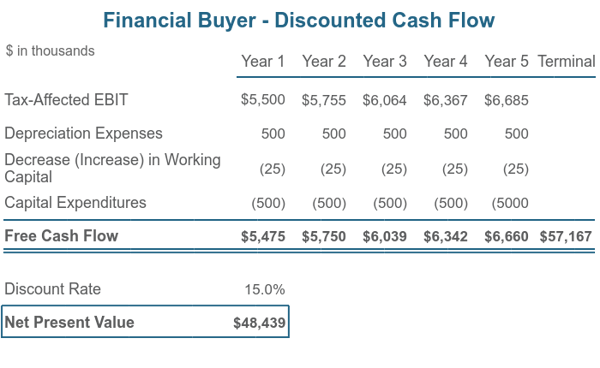

Company A is for sale and is currently being marketed to a financial buyer and a strategic buyer. Company A has provided both potential buyers its financial forecast for the next five years. Both buyers assume a 15% discount rate and a 3% terminal growth rate.

Relying on Company A’s financial forecast, the financial buyer calculates a value of $48.4 million based on a discounted cash flow valuation model. There are no synergy opportunities for the financial buyer, so it analyzes Company A on a stand-alone basis:

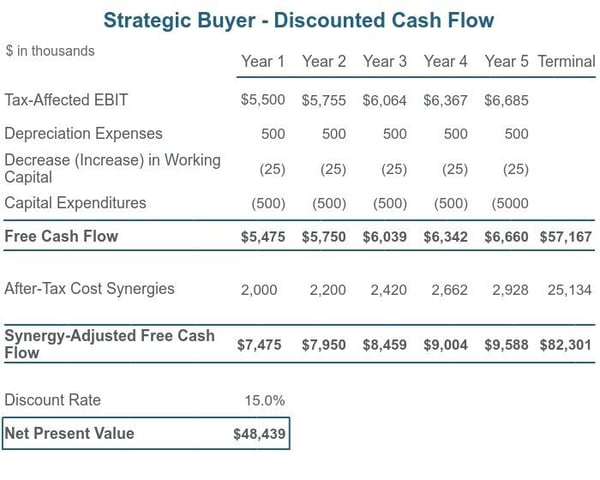

The strategic buyer uses the same valuation methodology but incorporates the perceived synergies identified in the due diligence process. The strategic buyer plans to merge Company A into its operations and eliminate duplicative positions.

The strategic buyer uses the same valuation methodology but incorporates the perceived synergies identified in the due diligence process. The strategic buyer plans to merge Company A into its operations and eliminate duplicative positions.

The strategic buyer expects that its HR, payroll, and administrative staff can manage the needs of Company A. Based on Company A’s employee expenses, the strategic buyer determined that the elimination of these duplicative positions would generate after-tax cost savings of $2 million in year 1 and would grow 10% annually consistent with increases in payroll and other expenses. This cost savings increases forecasted free cash flow used in the discounted cash flow analysis:

The strategic buyer’s investment value of $68.9 million incorporates the values of the synergies. The $20.5 million difference in net present value calculated by the strategic buyer compared with the financial buyer is the synergy premium. This amount is equal to the net present value of the after-tax cost synergies.

The strategic buyer’s investment value of $68.9 million incorporates the values of the synergies. The $20.5 million difference in net present value calculated by the strategic buyer compared with the financial buyer is the synergy premium. This amount is equal to the net present value of the after-tax cost synergies.

This example assumes that the strategic buyer passes 100% of the synergy value to the seller in a transaction. In practice, this amount varies based on how the sale is negotiated and structured. According to research performed by Boston Consulting Group, sellers collect, on average, 31% of the capitalized value of expected synergies. Applying this average to our example, the sellers of Company A would receive only $6.3 million of the synergy premium, or $54.7 million in total.

As you can see, synergies significantly impact what a strategic buyer is willing to pay for an acquisition. Business owners may leave money on the table if they do not consider synergies when negotiating a sale to a strategic buyer. PCE has experience advising and negotiating sell-side transactions with strategic buyers. Contact us today to learn more.

Investment Banking

mrosendahl@pcecompanies.com

New York Office

407-621-2100 (main)

201-444-6280 Ext 1 (direct)

407-621-2199 (fax)

Investment Banking

New York Office

201-444-6280 Ext 1 (direct)

mrosendahl@pcecompanies.com

Connect

201-444-6280 Ext 1 (direct)

407-621-2199 (fax)