Industry Trends

Largest Transactions Closed

- Target

- Buyer

- Value($mm)

Even if you don’t want to sell your business today, it’s important to understand how a buyer would value your business so that you can better plan for an eventual sale. Understanding these valuation concepts is essential to reduce the risk of leaving money on the table.

There are two common approaches to valuing an operating business:

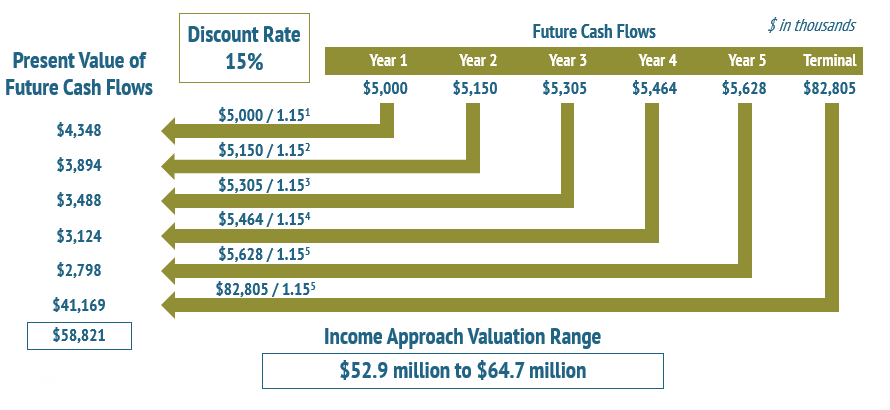

1. The income approach examines the future cash flow a business expects to generate and then discounts the future cash flow back to the present value to derive an intrinsic valuation.

2. The market approach compares a business to similar companies trading on the stock market or recently acquired, to derive a relative valuation.

The core principle of the income approach is the “time value of money,” which means a dollar today is worth more than a dollar in the future. This is because a dollar today can be invested and has the capacity to generate a return.

To calculate a business’s value today under the income approach, we discount the anticipated future cash flow of a business to its present value using a discount rate and discounted cash flow model.

Let’s assume your company has projected its cash flow for the next five years. Beyond these five years of projected cash flow, we need to calculate a terminal value, which is the present value at year five of all subsequent cash flows. To do this, we need to assume a long-term growth rate for your company. In this example, we have chosen 3%, which is in line with the average long-term inflation rate.

Next, to convert these future cash flows to their present value, we need to use a discount rate. A discount rate is the rate of return a reasonable investor requires in order to take on the risk of investing in a company. We often use the weighted average cost of capital as the discount rate, which includes a company’s cost of debt and equity. In this example, we have determined that this company’s discount rate is 15% based on an analysis of the company’s risk.

This company expects to generate $5 million in future cash flow in year one, but this $5 million is in future dollars. Because we want to value the company as of today, we divide the $5 million in year one by 1.151, which yields a present value of $4.3 million. We raise the discount rate to the first power to show that we are only compounding the cash flow once.

Year two cash flow is divided by 1.152. Raising the discount rate to the second power represents two years of compounding interest applied to the year two cash flow, which yields a present value of $3.8 million. We use this same approach for the next three years. Additionally, the terminal value will be considered a year five cash flow because we calculated the terminal value in year five.

The final valuation under the income approach is the sum of the present values of these future cash flows, resulting in a $58.8 million valuation. However, buyers often calculate a range of values in these methods. To illustrate this, we will apply a 10% premium and discount to this value, resulting in a valuation range of $52.9 million to $64.7 million.

There are two main valuation methods within the market approach:

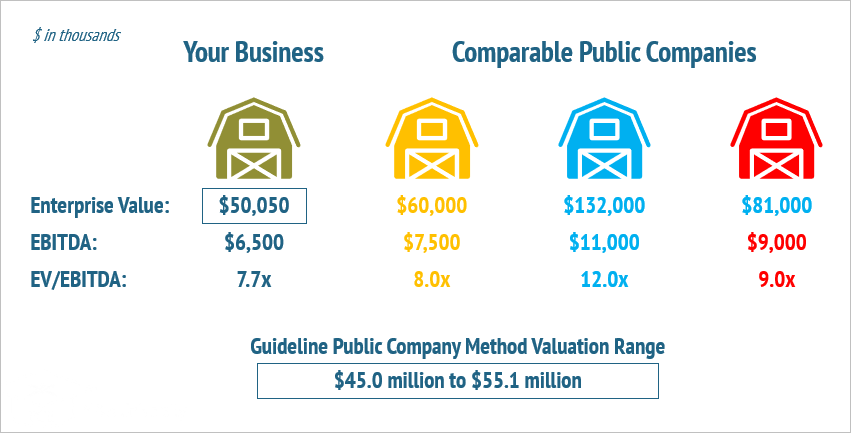

1. The guideline public company method values the target company based on comparative valuations of similar publicly traded companies. We consider where these stocks are trading at as representing how the market values companies in this industry and apply the comparable companies’ trading multiple to the target company.

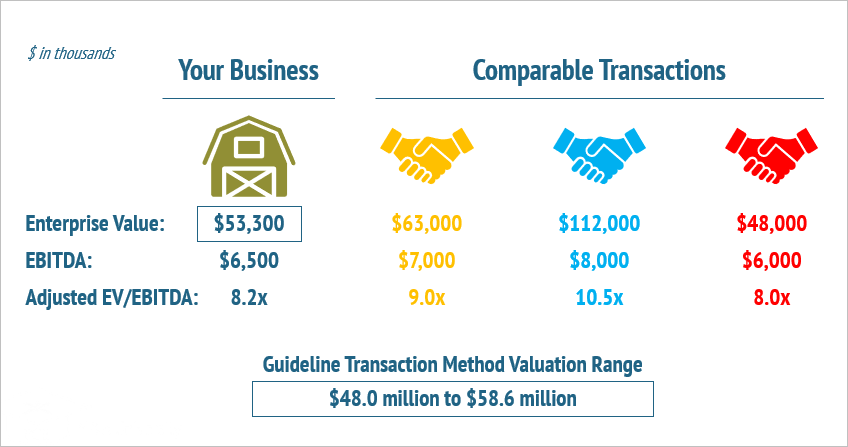

2. The guideline transaction method values the target company based on comparative valuations of similar companies recently acquired. We consider the multiples these companies were sold for as representing how the market values companies in this industry and apply these multiples to our target company.

To perform a valuation under the guideline public company method, we would first identify comparable publicly traded companies. These are companies that operate under similar business models to that of the business being valued. We would then analyze the enterprise value implied by their stock price and divide it by their EBITDA statistics to calculate their EBITDA multiples.

In the example below, we calculate an average EBITDA multiple of 9.7x. However, this average may need to be adjusted for a size premium or company-specific risk. Smaller private companies often have higher risk profiles than do publicly traded companies, so an adjustment to the average multiple is required to account for this risk. An analysis of the target company’s risk profile is needed to determine how risky the company is, its relative size, and, ultimately, what kind of adjustment needs to be made. In this example, we determined that the company would need a 2.0x adjustment for its smaller size, resulting in an adjusted EBITDA multiple of 7.7x.

This adjusted EBITDA multiple would then be applied to this company’s $6.5 million of EBITDA to calculate an enterprise value of $50 million. Again, the buyer will apply a 10% discount and premium to build a valuation range of $45 million to $55.1 million.

As in the previous example, we are looking to calculate your business’s enterprise value by benchmarking it against similar companies. However, instead of looking at companies trading on the stock market, we will look at recent transactions in the industry and observe the closing enterprise values of the transactions. Similarly, we will analyze the EBITDA these companies were generating when they were sold and calculate their EBITDA multiples. A buyer will typically consider transactions in the previous two to three years as representative of current market conditions.

In this example, the yellow and red transactions both occurred within the previous two years, so they could be representative of current market conditions. However, the blue transaction, which occurred five years ago, had an EBITDA multiple of 14.0x compared to the more recent transactions with multiples of 8.0x and 9.0x. With this information, we can conclude that the market is viewing companies in these industries at lower multiples today compared to five years ago. Therefore, we rely less on the blue transaction and more on the yellow and red transactions. To reduce reliance on the blue transaction, we will apply a 25% discount to it. This yields an average adjusted EBITDA multiple of 9.2x.

We then determine what the company-specific adjustment needs to be for this company. We observe that recently acquired companies had similar EBITDA compared to the target business and conclude that a 1.0x adjustment is appropriate, resulting in an adjusted EBITDA multiple of 8.2x.

This adjusted EBITDA multiple of 8.2x is then applied to the target company’s EBITDA of $6.5 million to calculate an enterprise value of $53.3 million. As with the previous two examples, we want to apply the 10% premium and discount to create a valuation range. This calculation yields a valuation range of $48 million to $58.6 million.

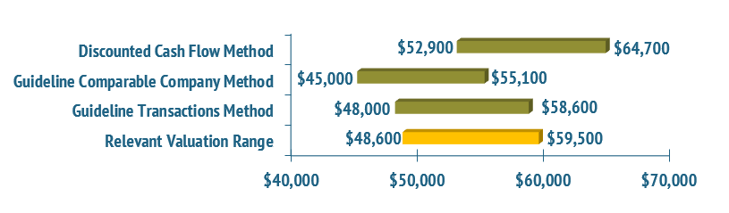

A buyer will often calculate the final valuation as an average of the three most common valuation methodologies. Below is a graphical “football field” example of a final valuation summary. The three methodologies we discussed in the example are displayed in the green boxes. The final valuation range summary is presented in the yellow box, representing the average of these three methods. This results in a valuation range of $48.6 million to $59.5 million.

Now that you know the three most common valuation methodologies that buyers would use to value your business, you can perform a similar analysis on your business to estimate your company’s worth. It is useful to know this information so you can be prepared for unsolicited offers from buyers and better evaluate those offers.

If you have any questions about how a buyer would value your business, please reach out to us. PCE investment banking and valuation experts are happy to answer any questions you may have.

Investment Banking

New York Office

201-444-6280 Ext 3 (direct)

mmoran@pcecompanies.com

Connect

201-444-6280 Ext 3 (direct)

407-621-2199 (fax)