Industry Trends

Largest Transactions Closed

- Target

- Buyer

- Value($mm)

Last updated:

Selling to an Employee Stock Ownership Plan (ESOP) is one of the most flexible exit options available for business owners. This flexibility allows for meaningful wealth diversification for business owners and provides significant long-term benefits for employees, thus helping the company attract and retain key talent. Understanding how to structure your ESOP is critical to ensure sufficient shareholder liquidity and set the company up for long-term success.

Understanding your primary goal is the first step. Whether you aim to maximize liquidity for all shareholders, buy out a single partner, or enhance employee benefits, clarifying your purpose will help narrow down the structuring options and save time and money.

Selling to an ESOP allows for a custom-designed solution that ensures the business owners’ and the company’s needs are met. To create the right ESOP structure, you’ll first need to perform a feasibility study, during which you and your advisor analyze your business and ensure that the selected structure maximizes owner and company objectives.

This article discusses the most common structures and how you and your company will decide among them. While ESOPs aren’t the answer for all business owners, they do offer the most flexible liquidity strategy. If you're weighing your options, consider these five factors before selling to an ESOP. As an experienced ESOP advisor, PCE can help you navigate the options.

Once you decide to sell to an ESOP, engaging an advisor to perform a feasibility study is crucial. We’ll help you analyze the following key questions before selecting a structure.

Given that ESOPs are incredibly flexible, most transactions involve a great deal of discussion around which structure would benefit the business owners and company the most. A well-structured ESOP transaction process ensures a smooth transition and maximizes value for all stakeholders. These decisions are typically resolved through a collaborative process involving the selling owners, the management team, and the advisors.

The decision of how much to sell should be driven primarily by your goals as the selling business owner. For example, you may desire to retain upside by continuing to hold equity, or you may want to preserve equity to sell or gift to management or family at a later date.

ESOPs are not required to purchase a specific percentage and can own anywhere from 1% to 100% of the equity at the close of the transaction. If you're looking for more liquidity while maintaining ownership, selling a piece of your company to an ESOP could be an attractive option. Therefore, depending on the level of equity you desire to retain post-close and your company’s long-term goals, you could choose to sell a partial interest that would preserve future flexibility, or you could sell 100% of your business to the ESOP.

One key difference between minority and majority ownership levels is how much control each party holds. If the ESOP becomes a majority owner, it will likely need to include requirements for an independent board of directors to ensure corporate independence. However, ESOP trustees do not guide day-to-day management decisions.

The final critical consideration is your selected tax structure. Because an ESOP is required to own stock in a company, many companies must reorganize their corporate structure to allow for the ESOP sale. In this section, we highlight important features of each selected structure.

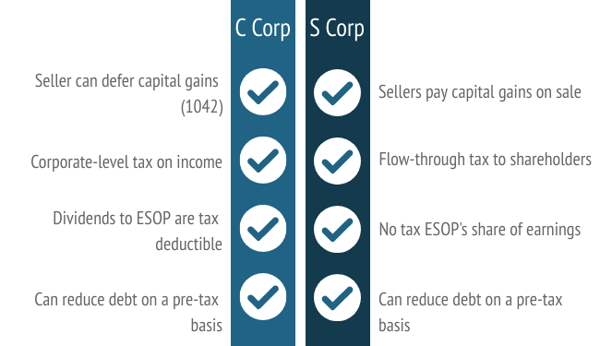

To own stock, your company must be organized as a C corporation or an S corporation post-transaction. There are diverging interests at play in this decision. Let us review a side-by-side comparison.

A C corporation structure allows you, as the selling business owner, to defer any capital gains tax, potentially indefinitely. If the company is an s-corp at the time of the sale, you will pay capital gains tax on any gain recognized in the sale.

An S corporation is a pass-through entity, and any income tax flows through to its shareholders. An S corporation wholly owned by an ESOP is a federally tax-exempt entity. Therefore, any income passed through to the ESOP trust, a tax-exempt entity, is shielded from tax liability. Therefore, a 100% S corporation would provide your company with the greatest tax shield that an ESOP can provide.

The choice between C and S corporations changes how shareholders receive income (distributions/dividends) and how your company is taxed (directly or as a pass-through). Therefore, this decision typically involves a great deal of analysis to ensure both you and your company maximize benefits.

If you sell a partial interest in your business, you can choose to sell the amount of equity that your company can finance through senior lenders. By doing so, you ensure you receive the entire transaction proceeds at the close. This allows you to begin diversifying your wealth away from the business while keeping equity upside for a potential future sale.

In 100% scenarios, the most common transaction structure involves both senior and seller financing. Seller financing is used to bridge the gap between the third-party financing and the purchase price. Once the senior debt is repaid, the seller notes are typically refinanced in stages. To align interests, you usually receive a synthetic equity component, such as a warrant, as part of the financing arrangement. By incorporating this measure, you receive a market rate of return for the risk associated with the subordinated nature of the seller notes.

Another option is to select C corporation structure at close so that you can defer capital gains. Then your company converts to an S corporation after the allowable period (note that this can take as long as five years). This structure allows you to defer capital gains, and your company can ultimately become a federally tax-exempt entity.

Selling owners have several ESOP financing options, from varying tranches of debt to equity. Depending on the selected financing partner, the oversight and cost of financing will be very different. The most common forms of debt financing are senior and seller financing. Financing from a Senior Lender, like a bank, is the least expensive but comes with the most oversight and restrictions. Seller financing provides the greatest flexibility for your company and earns you interest income through the life of the note, but it does not provide you with immediate diversification on its own.

Typically, this decision is driven by how much liquidity you require at the close of the transaction. If the capital raised through the debt markets does not meet the needs of the transaction, equity financing for ESOP transactions is available. Private equity partners are the most popular choice in the ESOP space; however, using these partners will increase the transaction cost, as their required rates of return typically far exceed those of a debt partner. Instead, you may decide to continue to hold equity or take some of the proceeds as seller financing.

Your company could also use employee benefits – 401(k) funds – to finance the transaction. However, this presents added complexities and can delay the closing. Therefore, clients rarely choose to pursue this option.

Governance, Compensation & Legal Considerations in ESOP Structuring

When structuring an ESOP, several considerations overlap with a traditional M&A sale. Working with the right professionals is key—here’s how to hire the right advisor for your ESOP transaction. These include setting executive compensation to align with the ESOP’s long-term goals, establishing a board of directors to effectively govern and guide the ESOP, and deciding if certain operations or assets should be spun out from the ESOP. Additionally, it's essential to review and update related party agreements to avoid conflicts of interest. Addressing these elements is crucial for creating a robust and sustainable ESOP structure.

Ultimately, the answers to these questions depend on your goals. As discussed, an ESOP is an incredibly flexible structure allowing you to customize the transaction to meet your needs and those of your company and employees. Given the complexity of ESOPs, if you or your company is interested in exploring this type of transaction and its benefits, we recommend you engage with an advisor to perform a feasibility study as the right first step.

Selling your business is a major decision—why not choose a strategy that maximizes your proceeds, minimizes taxes, and secures your legacy?

Fill out the form below to contact our expert ESOP advisors today. Let’s discuss if an ESOP is right for you.

Investment Banking

Atlanta Office

404-994-4186 (direct)

kwishing@pcecompanies.com

Connect

404-994-4186 (direct)

407-621-2199 (fax)