Industry Trends

Largest Transactions Closed

- Target

- Buyer

- Value($mm)

A letter of intent (LOI) is often among the first documents negotiated in an M&A deal, and for good reason. The LOI declares a commitment between the buyer and the seller to enter a transaction, and it outlines the key terms of the transaction agreement. By defining binding and nonbinding terms of the agreement, the LOI provides protection to all parties involved.

An LOI is an important early step because it creates a basic framework for the deal, which helps facilitate the negotiation of the definitive documents. And by holding all parties to agreed-upon responsibilities and expectations, the LOI ensures that the transaction moves forward smoothly.

When negotiating an M&A transaction, the buyer and seller must agree on several terms. The terms are included in the LOI as either nonbinding or binding transaction terms.

The LOI includes the purchase price as well as details about the form, timing, and manner of payment. The LOI should also specify how much will be paid at closing versus after the closing, and whether any contingencies exist for future payments.

The structure of a transaction—stock sale, merger, or asset sale—is important to include in an LOI, as it impacts purchaser liability, tax treatment for both buyer and seller, and closing mechanics. The structure terms should also disclose whether the seller will maintain post-closing ownership of the business, or “rollover equity.”

Contingencies are requirements that must be met prior to transaction close. Examples of contingencies are due diligence, permits, internal board approval, external approval from government agencies or lender, definitive agreements, and any other issues defined by the buyer or seller. Including contingencies in the LOI is important so that transaction expectations for each party are clear.

An LOI will often describe the buyer’s proposed due diligence review. The terms will include the scope of the review, access to information, and any limits to employees, customer or vendors set by the seller.

The target working capital is one of the most important terms to negotiate because it affects the value of the acquisition. The LOI will set the target working capital the business must have at close. The purpose of this term is to make sure the owner keeps operating the business in the normal course. Otherwise, since owners keep their cash at the close, they would benefit—at the expense of the buyer—by having receivables paid faster than normal and by increasing payables.

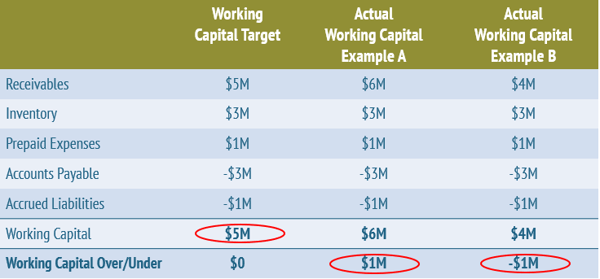

Working capital is typically the total of receivables plus inventory plus prepaid expenses less accounts payable and accrued liabilities. At the close, if the owner delivers an amount higher than the agreed-upon target, the owner will receive the difference. Conversely, if the owner delivers less than the target, then either the purchase price will be reduced or cash will be left in the business. The payment gets trued up or down after the close.

In the example below, the working capital target has been set at $5 million. In example A, the actual working capital delivered at the close is $6 million due to a $1 million increase in receivables, which means that the seller receives an additional $1 million at the close. In example B, receivables have decreased to $4 million at close, so the working capital delivered at the close decreases to $4 million as well. As a result, the buyer’s purchase price is reduced by $1 million.

In an M&A deal involving a private company, an exclusivity provision bars the seller from negotiating or soliciting offers from other potential buyers for a certain time. The period of exclusivity is a critical term to include in an LOI because it often drives the timeline for other elements of the transaction process, such as the negotiation of agreements and the due diligence process. While it is important to disclose an exclusivity period in the LOI, parties sometimes agree later to extend the period.

The confidentiality terms of an LOI typically reaffirm an executed nondisclosure agreement (NDA). This ensures that the deal remains confidential throughout the transaction process, particularly as more in-depth due diligence begins.

This provision identifies which jurisdiction’s laws will govern any disputes that may arise.

Clearly communicating the binding and nonbinding terms of an LOI helps ensure that the parties uphold their responsibilities, preventing breach of the LOI and any ensuing recourse actions. For this reason, a well-executed LOI increases the likelihood of a successful transaction closing.

When you are negotiating an LOI, engaging a strong team with broad transaction experience will help you navigate the process efficiently and effectively. PCE has worked with numerous business owners to reach successful deal closings. Please contact us to see how we can help.

Investment Banking

mrosendahl@pcecompanies.com

New York Office

407-621-2100 (main)

201-444-6280 Ext 1 (direct)

407-621-2199 (fax)

Investment Banking

New York Office

201-444-6280 Ext 1 (direct)

mrosendahl@pcecompanies.com

Connect

201-444-6280 Ext 1 (direct)

407-621-2199 (fax)