Industry Trends

Largest Transactions Closed

- Target

- Buyer

- Value($mm)

Last updated:

Employee Stock Ownership Plans (ESOPs) provide significant benefits to business owners, and as a result, the ESOP liquidity strategy has become increasingly popular. This strategy, however, is not without complications, so you must understand the ESOP transaction and implementation processes before you decide to implement an ESOP at your company.

As you begin to transition out of your business, ask yourself whether an ESOP would genuinely benefit your company and help you achieve your personal and corporate goals. Furthermore, be aware of the top seven mistakes that prevent ESOPs from being successful:

7. Unrealisting Timing Expectations

6. Inadequate Financial Reporting and Forecasting

5. Overvaluing the Business or Overleveraging the Transaction

4. Underestimating the Tax Impact

2. Lack of Employee Communication and Engagement

1. Building an Incomplete or Inexperienced Team

One of the most common mistakes business owners make during the ESOP transaction process is having misguided timing expectations. We educate business owners on the length of time required to implement an ESOP, so as to ensure the timing fits with each owner’s goals. ESOP installations typically close within four to six months, which is usually less time than it takes to sell a business to a third party but more time than it takes to get a bank loan.

But the ESOP process needs to begin long before the installation. Experts recommend that you begin planning your exit five to ten years before you ultimately want to retire, allowing an ample window for completing the transaction within your preferred time frame. Providing yourself sufficient time for planning ensures your company is ready to engage in an M&A transaction and is prepared to share historical and forecasted details about its operations, financials, and business plan.

PCE’s typical process of creating an ESOP includes an analysis of four main areas: your company, your company’s financial situation, the existing corporate structure, and shareholder goals. This analysis allows us to tailor the ESOP to your and your company’s needs and goals.

During the ESOP transaction process, the feasibility stage, which involves determining the appropriate structure and related terms, lays the groundwork for the rest of the transaction, including the negotiation process between sellers, lenders and ESOP trustees.

A business owner selling a company must inform the buyer of the company’s current financial situation. Due diligence is the method by which the buyer researches, verifies, and confirms the company’s overall health and profitability, and this is often the most daunting step for the seller.

Proper preparation for this phase of the ESOP process is vital to the transaction’s timing. You must have adequately prepared financials with as much supporting documentation as possible. Supply the highest quality of financials possible, in order, audited, reviewed, and compiled. Below is a list of basic documentation your buyer will expect:

| Revenue Analysis | Customers, products, distribution channels, geography, pricing, strategy, key contracts, etc. |

| Expense Analysis | Cost of sales, SG&A, R&D, corporate overhead, key suppliers, etc. |

| Analysis of Assets and Liabilities | Leases, plants, real estate assets, heavy equipment and machinery, etc. |

| Analysis of Company Cash Flows | Projected debt service, operating cash flow analysis, working capital levels, etc. |

| Seller Assumptions and Projections (3-5 years) | Review and sensitivity of assumptions on profitability, operations, and cash flow |

Accurate company valuations are of the utmost importance when it comes to establishing an ESOP. The Tax Reform Act of 1986 requires a fair market value appraisal when the ESOP first buys the employer corporation stock and at least annually after that. Because an ESOP is a qualified retirement plan subject to DOL scrutiny, the company’s shareholders, advisors, and trustee should agree on an arm’s-length transaction whereby the company and the shareholders, as well as the ESOP trustee, engage separate financial advisors to perform appraisals based on the fair market value standard. These competing valuations drive the negotiation process and ultimately result in an agreed-upon purchase price. The DOL has intervened post-transaction when the terms of a transaction have exceeded fair market value and unfairly harmed employees. To avoid future litigation and provide for the ESOPs long-term success, spend sufficient time analyzing your company’s value with qualified professionals.

A qualified financial advisor will ensure this process runs smoothly and will also be critical to raising capital to finance the transaction. Shareholders and management are encouraged to monitor leverage levels when entering into a highly leveraged transaction, because a deal that approaches 6.0x total leverage and 3.0x senior leverage faces a potential regulatory issue and enhanced underwriting from your lender. Be sure to undertake a thorough analysis of debt capacity to determine appropriate levels of both senior and subordinated financing, with a particular focus on cash flow coverage and leverage ratios.

When setting up an ESOP, it’s essential that you secure funding with a reliable third party that understands the complexities of the ESOP process. An ESOP significantly changes a balance sheet, requiring a review to determine how best to establish the loan structure and the covenants. The lending partners should demonstrate a history of experience and expertise, which will allow them to help structure the ESOP transaction’s terms and conditions correctly.

Implementing an ESOP changes a company’s tax structure and can create new tax deductions or deferrals. You can achieve maximum tax benefits by accelerating your company’s deductions and deferring income. Ensure that your accounting standards allow this and that you’ve planned appropriately. You must also consider large capital expenditures, prepaid expenses, deferred revenue, and other accruals during this process. Consult with your investment banker to find a qualified CPA firm that has experience with and knowledge of all the ESOP tax advantages. A qualified CPA firm can provide audit protection by ensuring you’ve considered all tax liabilities before converting your business to an ESOP. After you’ve implemented the ESOP, you can maximize other tax benefits—and perhaps ease tax compliance complexity - through a change in accounting methods to best reflect the book treatment of items such as depreciation, inventory, and prepaid expenses¹.

One of the most discussed benefits of converting your business to an ESOP is the Section 1042 tax deferral for owners of C corporations. Section 1042 of the Internal Revenue Code enables the seller to defer all capital gains taxes associated with a sale by reinvesting the proceeds into a qualified replacement property. If the seller intends to pass these assets on to his or her heirs, numerous options involving FLPs or CRTs could maximize estate planning opportunities.

Shareholders and companies that want to engage in an ESOP transaction to facilitate a succession strategy should hire qualified CPAs and wealth managers who understands ESOPs and are prepared to maximize benefits for all stakeholders.

Only an experienced ESOP professional should complete the actual task of creating an ESOP, because it involves an incredible amount of detail. Many advisors design plans with the thought that the companies will continue in perpetuity, and while that may be the intended plan, you must consider the possibility that your company will be the target of an acquisition. An ESOP designed for flexibility will include provisions for what happens with unallocated ESOP shares, as well as payout to the shares that have already been allocated in the case of sale.

Additionally, the language in ESOPs often neglects to include provisions for management-based incentive plans such as stock appreciation rights. When you adequately consider executive incentives at the time of the transaction, you can ensure your company has sufficient resources to align interests for senior management with the ESOP.

ESOP design problems typically occur as a result of one or more of the following:

Repurchase obligations represent one area where ESOP design can significantly impact future cash flow. To avoid this, focus on the internal ESOP loan amortization to manage benefit levels, eligibility, and vesting of employees; diversification; and distribution policy. Hire a qualified advisor to ensure your plan includes features to safeguard the company and its employees in various scenarios.

Once you’ve determined the ESOP transaction structure and the process is underway, pay particular attention to employee and board communications. It’s in your company’s best interest to communicate the decision properly to employees to ensure the new corporate structure’s success post-close. If you view the ESOP solely as a way to exit your business, you won’t be able to guarantee that the company will truly reap the benefits of its new ownership structure.

The first step to introducing an ESOP properly to your employees is to hold a rollout meeting at the conclusion of the transaction. This meeting, when executed correctly, ensures alignment between employee and company interests. Typically, the rollout process lasts 12 to 18 months, and by the end of a successful rollout process,² all employees will:

The ESOP ownership structure doesn’t require financial disclosure on an operating basis, but when your company ensures employees understand how their roles impact financial performance, employees are more likely to appreciate the impact they have on the company’s valuation. Consistent communication with all stakeholders is a crucial driver to corporate culture, and it helps ensure the company achieves its organizational goals and all employees understand their roles’ value.

Companies and shareholders must make sure they understand the extent of the complexities and nuances inherent in ESOP transactions. The first step to ensuring an ESOP is right for you is hiring a qualified investment banker to perform an in-depth feasibility study whereby valuation, liquidity and timing expectations can be set. By educating yourself before engaging all parties, you can determine the appropriate structure and terms to ensure you’re pursuing an optimal deal. There are other ways you can become acquainted with ESOPs such as attending ESOP conferences and speaking with trusted personal advisors to gain a greater understanding of what an ESOP would mean for you specifically. Each ESOP is a custom-built plan that transforms a company and its employees.

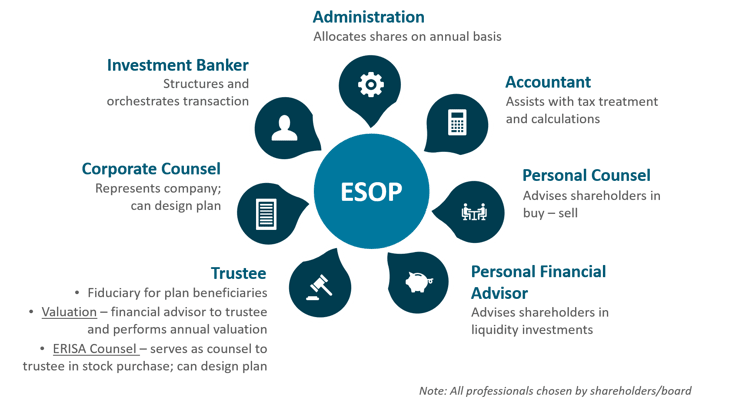

No one person or group can fulfill all the roles needed to create and integrate an ESOP. The ESOP and the benefits the company and the seller receive are only as good as the team they hire and assemble. Typically, a seller’s ESOP team consists of an investment banker, corporate counsel, an ESOP trustee and advisors, an ESOP administrator, a tax accountant, personal counsel, and a personal financial advisor.

During your selection process, conduct interviews with potential ESOP advisors and follow up with their references. It’s natural to want to choose service providers based on low cost, placing less emphasis on professional experience, but you must resist. Insist on demonstrated experience and expertise. Your experts should be members of one or more relevant professional organizations, such as the National Center for Employee Ownership or The ESOP Association. They should be willing to give you references and client lists. As you conduct your interviews, you’ll get an idea of reasonable pricing structures, so be sure to question any structures that are priced unusually low or high.³

Look for the following red flags:4

If you choose to convert your company to an ESOP, you can preserve and protect your company into the future by hiring advisors who possess substantial ESOP experience, negotiating at arm’s length with the ESOP trustee, and designing a transaction that addresses both corporate and employee goals, as well as shareholder liquidity expectations. ESOPs provide many benefits, but you’ll reap them only if the transaction is done right.

If an ESOP sounds like an appealing succession strategy, give PCE a call so that we can look at how an ESOP could help you achieve your succession strategy. Or, visit our ESOP Library to find additional resources to help guide you through the ESOP planning process.

Eric Zaleski

Eric Zaleski is a Managing Director at PCE and a key member of the firm’s ESOP Advisory Group. Based in the Chicago area, he brings 25 years of experience helping middle-market business owners implement and finance complex ESOP transactions.

Investment Banking | ESOP

Chicago Office

847-239-2466 (direct)

ezaleski@pcecompanies.com

Connect

847-239-2466 (direct)

407-621-2199 (fax)