Industry Trends

Largest Transactions Closed

- Target

- Buyer

- Value($mm)

Last updated:

Private equity buyers often prefer that selling shareholders retain minority ownership in their business through an equity rollover. It is essentially a “reinvestment” by the seller in the business post-transaction and reduces the cash proceeds available at the close. There are several factors a selling shareholder must consider to fully understand the risks and rewards associated with an equity rollover.

A private equity buyer views an equity rollover as a positive signal that the seller is bullish on the business’s future. If the seller retains a minority equity stake in the business post-transaction, the seller and buyer have aligned interests, and both have “skin in the game.” Buyers will often prefer the equity is rolled over by manager-owners of the business, which adds incentive for management to operate the business successfully. The equity rollover reduces the cash at close but provides the seller with an opportunity to participate in a “second bite of the apple” when the private equity buyer sells the business in four to six years.

The business’s capital structure will likely be very different after the transaction because the buyer will bring new debt to finance the acquisition. It’s important for selling shareholders to understand the ownership percentage their rollover equity would represent in the acquired business.

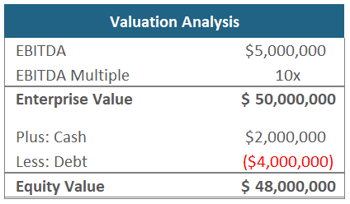

Let’s look at an example where we assume the selling business generated $5 million in EBITDA in the trailing twelve months (“TTM”) prior to the sale and the shareholders agreed to sell the business for a 10.0x multiple, or an enterprise value of $50 million. The company holds $2 million of cash and $4 million in debt on its balance sheet at closing. The sellers and buyer agreed on a cash-free, debt-free transaction.

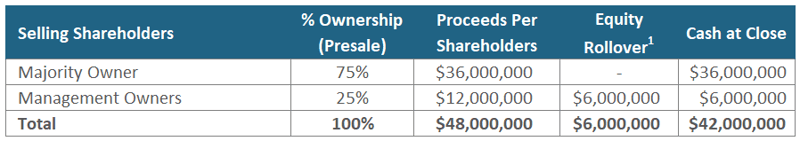

The selling shareholder group is 25% owned by the business’s management team, with a passive investor owning the remaining 75%. The private equity buyer has agreed to allow the management team members to roll over half their equity. Below is how the proceeds would distribute to the selling shareholders at the transaction close.

The management owners roll over 12.5% equity ownership, or $6 million, in the transaction. However, this does not equate to 12.5% equity ownership of the company post-transaction, due to the changes in the capital structure.

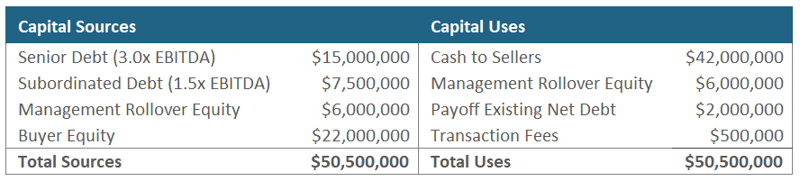

Now let’s view the transaction from the sellers’ perspective to better understand how the management owners’ rolled equity fits into the new capital structure. Buyers will use a sources and uses schedule to demonstrate the types of capital that will fund the purchase and how that capital is spent in the transaction.

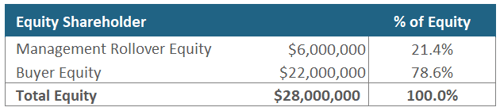

In this example, the buyer is leveraging the transaction with senior debt and subordinated debt. After the management equity rollover, the buyer is responsible for the remaining $22 million in equity, or cash, to fund the transaction.

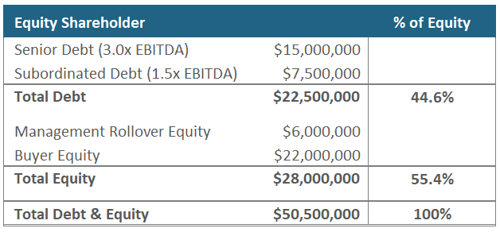

Post-transaction, the company’s capital structure will consist of $22.5 million of debt and $28 million of equity, or 44.6% debt and 55.4% equity.

Under this new capital structure, the $6 million equity rolled over by management represents a 21.4% ownership interest in the company’s equity:

Since the company’s capital structure has more debt than prior to the transaction, management’s rollover dollars represent a higher percentage of total equity compared with the 12.5% ownership represented pre-transaction.

A selling shareholder considering an equity rollover needs to understand the other capital providers’ terms and seniority and where the rolled equity fits in the capital structure. Debt used to finance the transaction will have priority over the rollover equity. Rolling shareholders need to be comfortable that the company will be able to support the annual interest burden and required principal repayments. Too much leverage stresses cash flow and puts equity holders’ distributions at risk.

Another factor to consider is whether the other equity will be pari passu with the rolled equity, meaning all equity holders have equal rights to distributions. Private equity buyers will often structure their equity as preferred stock with a minimum distribution that is paid before common stockholders. This is a way for private equity firms to secure a minimum return for their investors.

It’s also important to understand whether the rolled ownership includes a board of directors position. Board seats are usually only provided to shareholders with a substantial ownership, typically a minimum of 15%-20%. If the rolled equity does not include a board position, the rolling shareholders would be more passive investors in the business with no power to direct business plans, in which case it is important that they believe in the controlling shareholders’ plans for the business.

Understanding the business’s post-transaction capital structure is an important first step in assessing an equity rollover opportunity. Another equally important factor is knowing with whom you are investing and what the upside potential is. An equity rollover’s appeal is the participation in future growth and return generated when the new buyer sells the business. The rollover equity is an investment in the business as well as the new ownership group because that group will take control of the business.

Ask the buyers questions such as:

It’s best to feel comfortable that the new majority ownership group is competent to operate the business and will generate a return on your investment. Some private equity groups will provide insight into their expectations on exit value and investment returns to help rolling shareholders understand the opportunity.

A selling shareholder must analyze not only the risks and rewards but also the liquidity factor when considering an equity rollover. To participate in an equity rollover, the selling shareholder is forgoing cash at close in hopes of future returns. Since private equity investments typically have a duration of four to six years, the rolling shareholder needs to be comfortable with the investment’s illiquidity.

PCE has significant experience advising business owners on selling their businesses and evaluating equity rollover opportunities. Contact us today to learn more.

[1] Example does not consider possible taxes that could impact amount available to roll over.

Investment Banking

New York Office

201-444-6280 Ext 3 (direct)

mmoran@pcecompanies.com

Connect

201-444-6280 Ext 3 (direct)

407-621-2199 (fax)